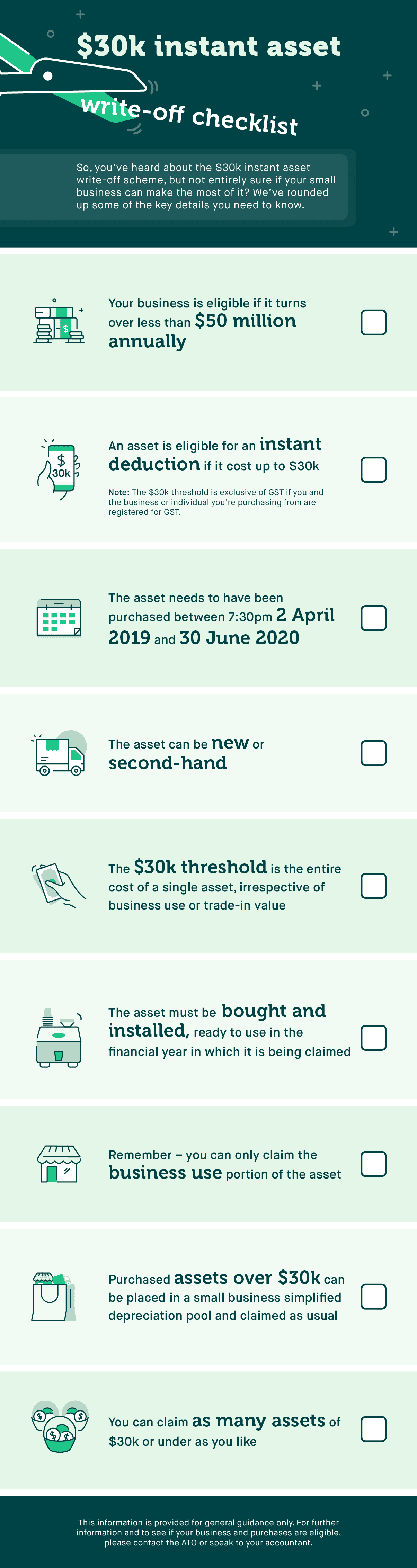

Infographic: Is your business eligible for the $30k instant asset write-off?

If you’re a small business owner, you may have heard about the government’s $30k instant asset write-off scheme, applicable to certain purchases made before 30 June 2020.

But how do you know whether your business or your purchases are eligible?

To help you out, we’ve compiled an overview of some of the criteria that your business and purchases need to meet before making a claim via the scheme. For more detailed information, visit the ATO website or speak to your accountant.

If you’re considering purchasing business equipment or assets to make the most of the scheme, but concerned about disrupting cash flow to do so, a small business loan from Prospa could be the answer. Find out more.