Create an awesome product page

Create clear well-structured content

Set out your information in a clear, concise way (and break it up a little with images and icons). This will make it nicer to look at – and much easier to read. Click on the headings to jump to each section

Headline >

Capture attention with a short, engaging headline.

Introduction >

Create a need and set the scene with a brief introduction.

Product information >

List the product information in point form.

About Us >

Demonstrate why your clients should choose you for business funding.

Clear call to action >

To tell them what you want them to do.

Writing a headline

Use a short engaging headline to capture the reader’s attention. Try to include a single benefit for the reader – and action-oriented language is great too.

Here are some examples:

- Apply today for business funding up to $1,000,000

- Grow your business and manage your cash flow

- Smooth application, fast decision and funding possible in 24 hours

- Flexible business funding solutions

Nailing the intro

TIP: Your intro should be no more than a couple of sentences. Remove all the unnecessary words, and opt for active language.

Create a need with a short introduction. Here are some examples:

As a business owner having access to finance is vital for you and your business. Take charge of your cash flow and your business aspirations today.

OR

What could your business do with extra cash flow? Renovate or expand, run a marketing campaign and gain more customers, hire more staff? Apply for business funding today and watch your ideas come to fruition.

OR

We offer fast, easy funding solutions to small businesses to keep up the momentum. If you need business funding to take advantage of an opportunity or to boost your cash flow, talk to us today – and get on with business, sooner.

OR

We offer business funding solutions with an easy application process and fast access to the funds. It just takes ten minutes to apply.

OR

Want a business finance solution with a smooth application process? All it takes is ten minutes to apply, you could get a decision the same day and the money you need could be in your account in 24 hours – so you can get on with business, sooner.

About us

If you want to introduce some facts about your experience, this is the place to do it. Remember, don’t be too over the top, a couple of sentences will do to help you win them over.

General wording

You don’t have to have an ‘About us’ section, it’s just a good spot to include some information to explain to clients the benefits of working with you.

Here’s some sample wording:

- We take the hassle out of getting business funding, we want to help you and your business access the funds you need to keep momentum going.

- We believe in small business and we’re here to support you with the funds to support cash flow or achieve your next goal.

Wording to introduce Prospa

You can also introduce your partnership with Prospa.

Here is some wording you could use for that:

- We’ve partnered with Prospa, Australia’s #1 online lender to small business.

Product info

TIP: Providing product information in point form can help to draw attention to the important features and to allow comparison.

TIP: Include images and icons to visually separate the information.

Free or cheap images:

Free icons:

Prospa has three products with distinct features – the Prospa Small Business Loan, the Prospa Plus Business Loan and the Prospa Business Line of Credit. You may talk about Prospa Funding Solutions in general or present the products individually.

Whatever you decide, below you will find Prospa information that has been approved for you to use.

Keep your business moving with a funding solution to suit your business needs

Need funds for an opportunity or to support cash flow? We can help you find a solution to suit your business. Enjoy fast, easy application on a Small Business Loan or a Line of Credit, with funding possible in 24 hours to approved applicants.

- Business funding from $5K to $1M

- Cash flow friendly repayments over terms from 3 – 60 months

- Apply online in 10 minutes, same day decision possible

- No upfront security required to access total funding up to $150,000

- Hassle-free process with funding possible in 24 hours

- Business financials for certain loan amounts may be required

Business Loans

If you need access to a lump sum to cover a one-off business expense.

- Loan amounts from $5K to $1M

- Fixed repayments over terms of 3 months up to 5 years

- Minimal documentation

- Business financials for certain loan amounts may be required

- Early payout option available

If approved, use your Small Business Loan to add a new product or service, purchase tools, upgrade equipment or machinery, do a renovation or fit out, run a marketing campaign, build a website and more.

Business Line of Credit

If you need ongoing access to funds to manage day-to-day business cash flow.

- Facility limit between $2K and $500K

- Use and reuse as often as you like

- Only pay interest on what you use

while you use it - 24-month renewable term

If approved, use your Business Line of Credit to manage cash flow gaps, pay staff wages, cover unpaid invoices, buy urgent stock, manage seasonal fluctuations, pay suppliers, manage late paying customers and more.

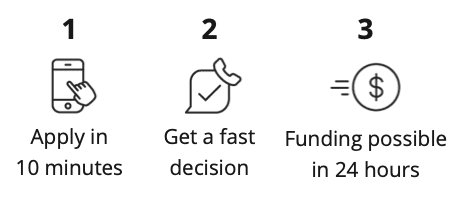

The fast process

Show how quick and efficient the application process is using a brief description and some icons.

Then show them how to make it even quicker by listing what is required to apply – in point form or using a paragraph of text.

IN POINT FORM

Here’s what to have ready

- Driver Licence

- ABN

- The BSB and account number of your main trading account

- 6 months of business bank statements

- Business financials for certain loan amounts may be required

IN A PARAGRAPH

For a seamless process

All you need to have ready is your driver’s licence number and your business ABN. You can choose to allow us to use an advanced bank verification system link to instantly verify your bank information online and your application will be processed faster, in which case – have your main trading bank account details handy. Alternatively, you can choose to upload copies of your bank statements. Please make sure you have 6 months of statements as PDF documents ready to upload. Depending on how much you want to borrow, you may need financial statements too.

The Call to Action

Once you’ve informed the reader about the products and the application process, you need to get them to take action. Make this as easy as possible – and give them options.

Do you want them to contact you?

At the very least you should include your phone and email details (with links if possible). Like this:

To find out more, contact us on {{phone number}} or email {{email address}}.

OR

Still have questions? Call us on {{phone number}} or email {{email address}}.

Even better, include a ‘Find out more’ button which links through to a phone number or opens an email.

Do you want them to Apply for funding?

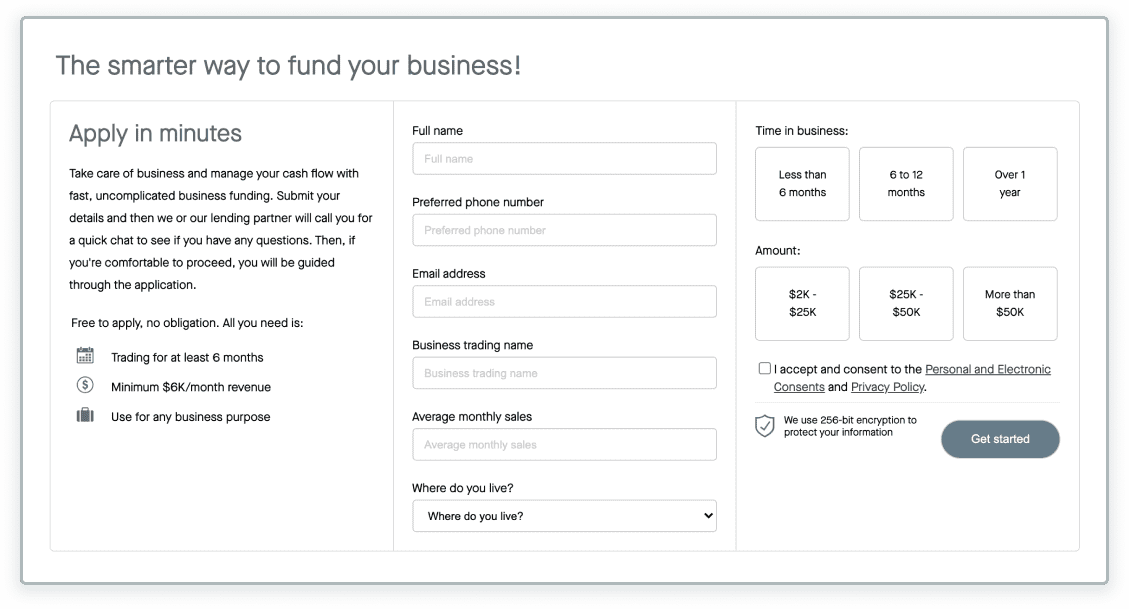

You can insert one or more ‘Apply Now’ buttons on your site. These should link to an online application form allowing your clients to apply any time of the day or night. We can supply you with one – see below for how to access the Prospa iFrame.

Include ‘Apply Now’ buttons in logical locations on your page. You might have one at the top, one after the product information and one at the end.

Get your unique Prospa Lead Manager (iFrame).

Talk to your dedicated Prospa BDM about getting your unique iFrame, a lead capture form that sits on your website.

This is a clever piece of tech that sends all leads direct to Prospa so we can follow up. We will automatically notify you and tag your client as your lead in the Prospa Partner Portal.

Frequently Asked Questions

The information on this page is provided for general information only. Nothing contained in this post constitutes advice or a recommendation of any kind by Prospa.

No repayment period available to approved customers who settle a new or refinanced Prospa Small Business Loan. Approved customers can elect to take an optional initial no repayment period of between 1 to 4 weeks from the loan settlement date, during which interest will accrue but no repayments will be required. Total loan repayment term will be extended by the time equal to the selected no repayment period (1 to 4 weeks) and interest will accrue from the loan settlement date until the end of the term. Interest that accrues on the loan during the no repayment period is capitalised and included in the total interest expense, and forms part of the regular fixed daily or weekly principal and interest repayments due on each payment date following the end of the no repayment period. Not available to refinance an existing Prospa loan that is within a no repayment period at the time of application. Product settings may be amended or withdrawn without notice.