Improve your cash position through cash management

Having a clear picture of the financial workings of a business is one of the fundamentals contributing to a business’s success – and this is mainly achieved through effective cash management. Cash management involves disciplined monitoring, forecasting and planning over the longer term to allow the business to be prepared for any financial situation or opportunity that arises in the short term too.

The financial workings of a business can be divided simply into three areas that cover the inflows and outflows of cash from the business. These are accounts receivable, accounts payable and inventory, all of which fall under the overarching banner of cash management.

Central to cash management is the cash flow statement, a report that consists of a detailed overview of all the business’s cash flow situation. Whether you do it yourself, hire an accountant or bookkeeper, or employ a financial controller in-house – effective monitoring of available working capital (or cash management) can help a business to remain competitive, be financially flexible and be ready for any growth or investment opportunities.

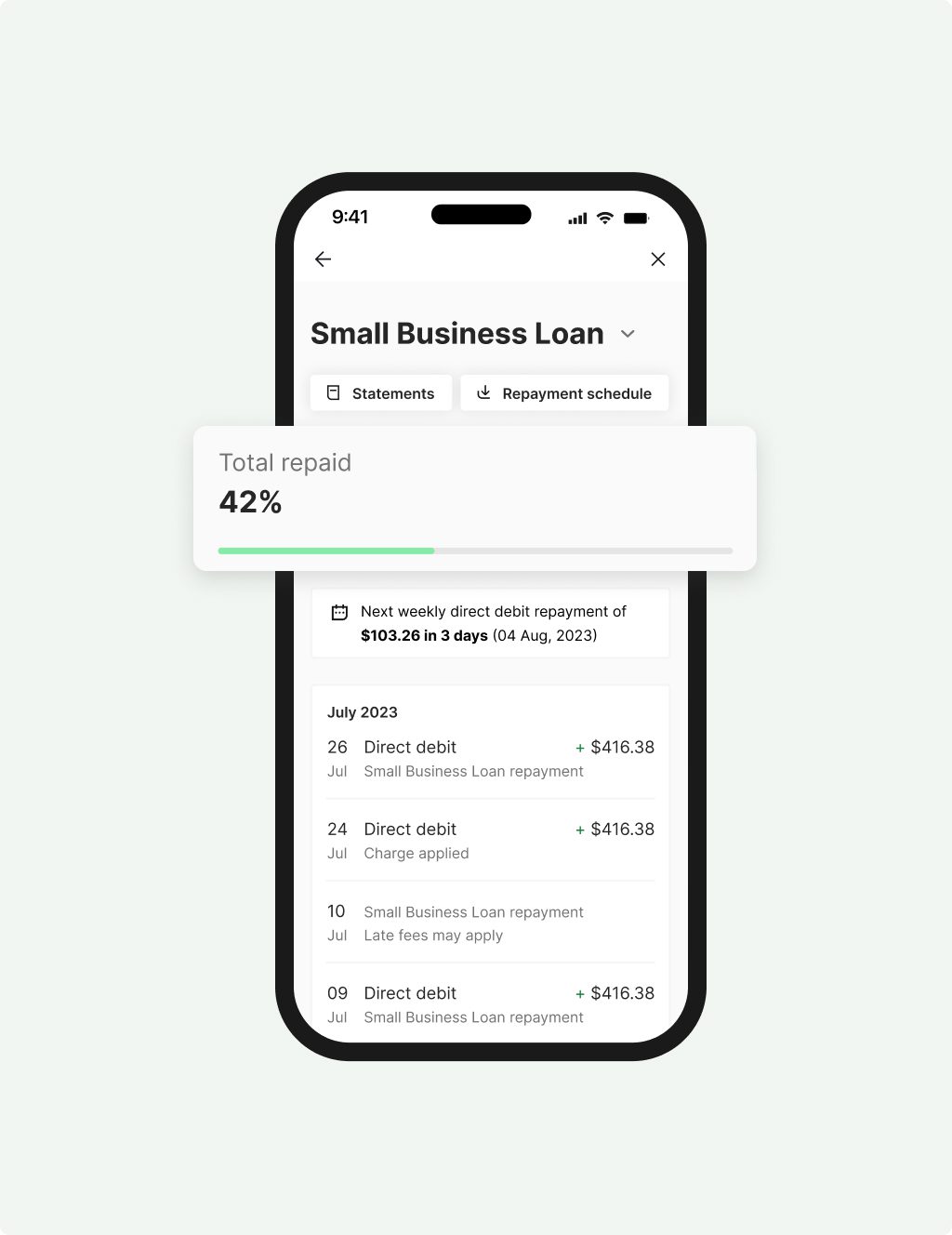

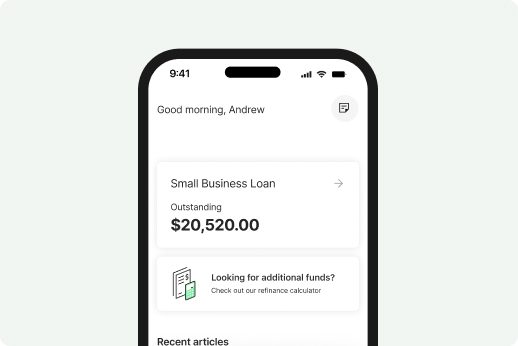

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

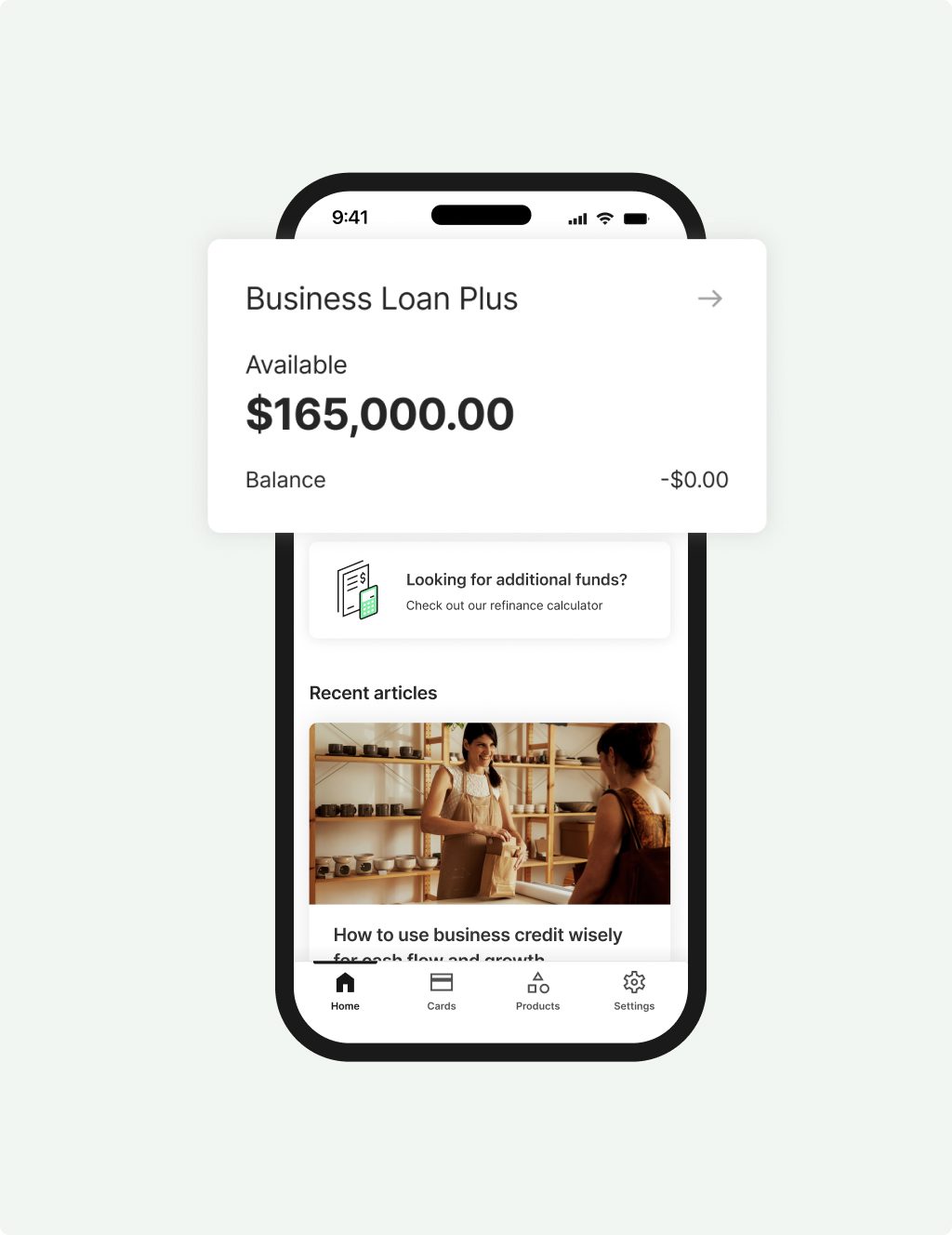

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

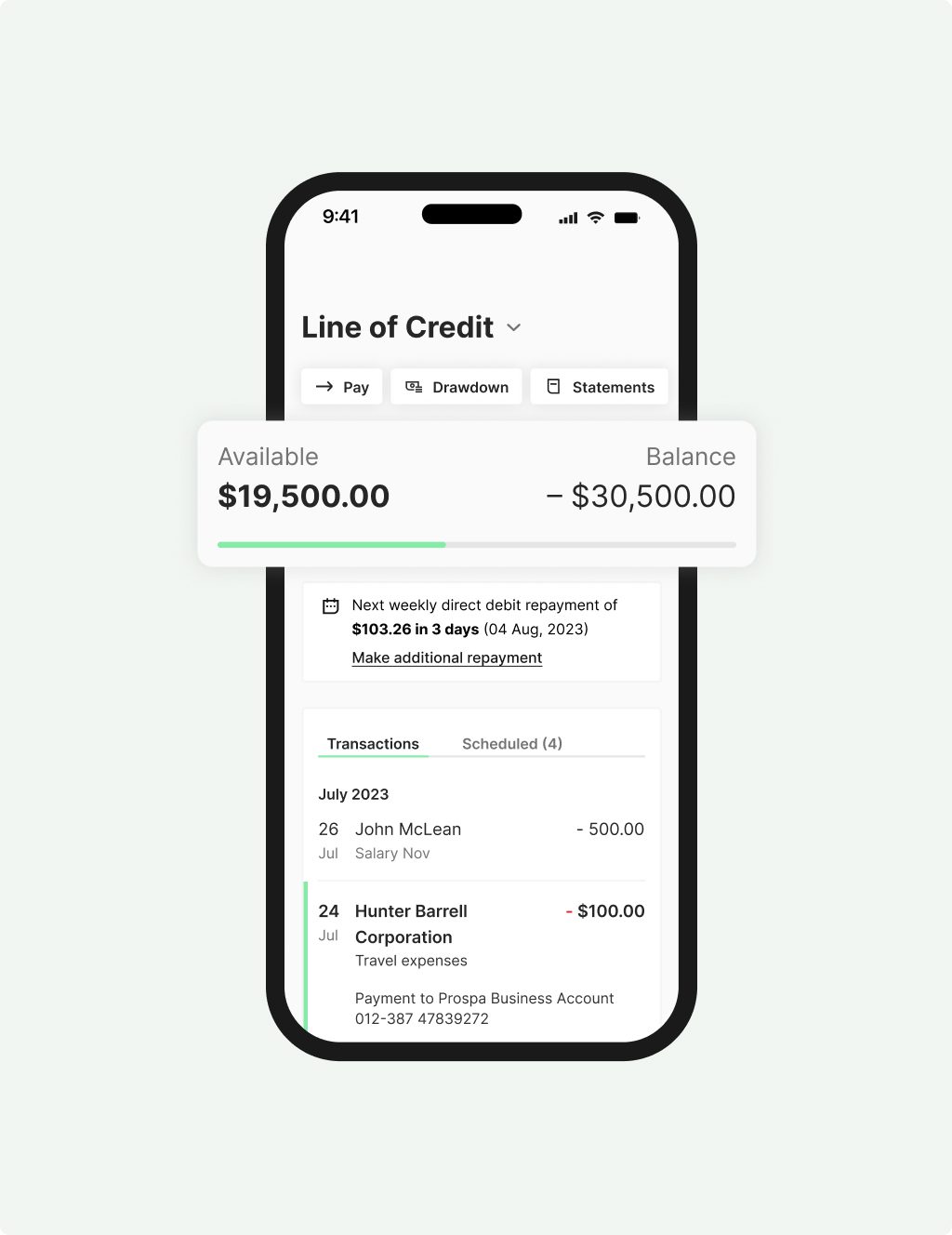

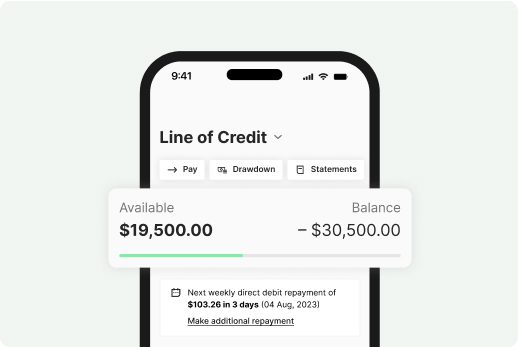

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Cash management support

There are some quick options for cash management support when it’s needed in the short term.

You could consider a Prospa Small Business Loan for larger purchases or investments or a Prospa Business Line of Credit designed to provide ongoing access to funds (up to an approved limit) and put the business owner in control.

Prospa supports small businesses with:

- Choice of product based on needs

- Funding options up to $1M

- Fast application and decision

- Funding possible in 24 hours

- Competitive interest rates

Cash management strategies for small businesses

Cash management can seem complex. However there are simple strategies that small businesses can adopt to help improve their financial situation. While some strategies for managing cash flow might work for one business but may not be right for the next, so a combination of the following can be a great addition to the business’s cash flow risk management practices.

Help ease the stress on your cash flow and boost the balance of your deposit accounts with these simple cash management tips, perfect fundamentals for small businesses to add to their corporate process.

- Review expenses – Find ways to save money and improve your financial situation through cutting expenses. Ask suppliers about any discounts they offer, diversify into different customer groups, plus consider using up existing inventory before purchasing new inventory. You could even consider hiring part-time or contract employees instead of full-time employees.

- Increase your margins – Boost working capital by either increasing what you charge or reducing the cost to produce or provide it. If there’s a strong demand for your product or service (or it’s something unique) this will likely be easier.

- Charge a deposit – Asking customers for a deposit is more than reasonable, especially for larger priced products or in service-based industries. While not all clients may be willing – it’s worth asking as it will definitely improve your cash balances.

- Talk to your suppliers about extended payment terms – Trust and being upfront is important, and your suppliers want to keep your business, so they could well agree. If they don’t, see if you can find an alternative supplier who will be more supportive of your working capital requirements.

- Encourage customers to pay faster – Offer a small discount for early payment which can be an attractive proposition for some customers, especially with regards to their own long term cash management situation.

- Get rid of idle equipment – When it comes to equipment, if you aren’t using it, get rid of it (or lease it out). You could also consider renting equipment at times you need it to conserve working capital resources.

- Structure workload effectively – Too much business can be overwhelming while not enough could mean your business fails. Getting the right balance is important for cash management. You could offer a discount to a client who is happy to postpone to a time you are expecting to be quieter. This strategy can also be a great way of managing your cash flow if you’re a seasonal business.

What are the benefits of cash management?

Effective cash management and planning can help ensure there’s enough of a cash balance on hand for a business to make purchases and take advantage of growth opportunities, it can assist the business to monitor cash flow requirements and pay bills, it helps the business plan for capital expenditure, and can put the business in a position to negotiate better finance terms. All these things are vital for a successful business.

What are different types of cash management tools?

There are plenty of online tools available to help with cash management. Here’s a free cash flow forecast spreadsheet to help you stay on top of your business cash flow and find out where your finances might need a boost. Download template here.