Solve end of year challenges with fast access to funds

- Flexible solutions up to $500K to suit your business needs

- Simple application and funding possible in hours

- No asset security required upfront to access Prospa funding up to $150K

9 out of 10 small businesses face challenges leading up to end of year

While the rising cost of goods and utilities, and lower than expected consumer spending top the list this year – some common end of year challenges can be overcome with the support of additional funding.

We've got you covered

Managing cash flow

Staffing challenges

Managing stock levels

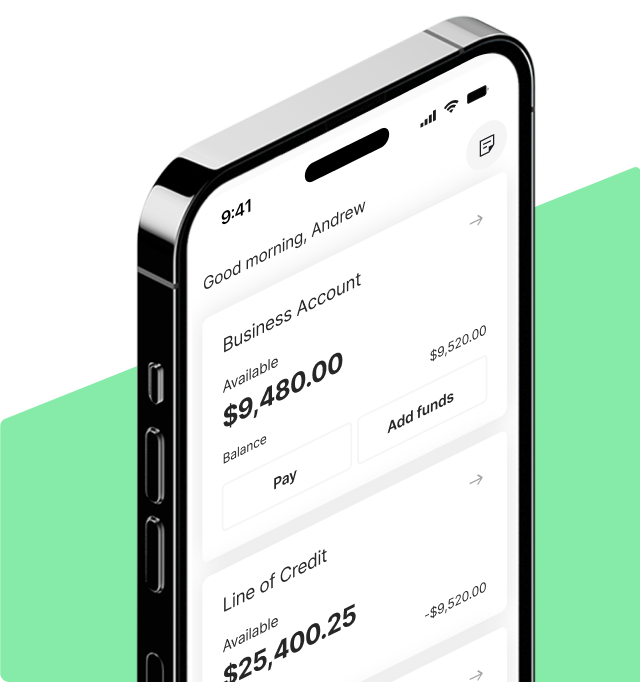

Already a Prospa customer?

Already a Prospa customer?

We know you, so it's quicker and easier to apply for funding when you log in to your Prospa account.

Log in to apply.

We know you, so it's quicker and easier to apply for funding when you log in to your Prospa account.

Log in to apply.

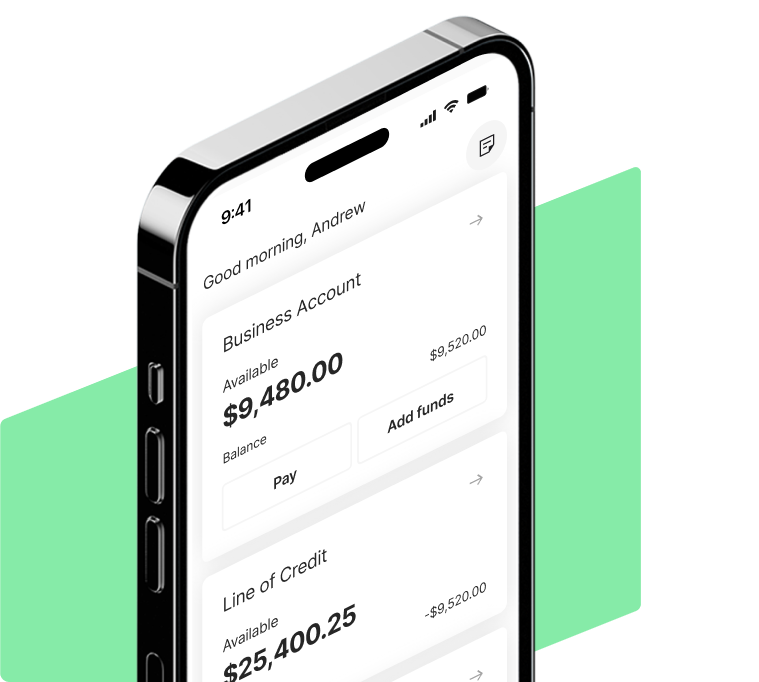

Business Line of Credit

- Renewable 24 month term

- Apply in 10 minutes with minimal paperwork

- No upfront security required to access up to $150K in Prospa funding

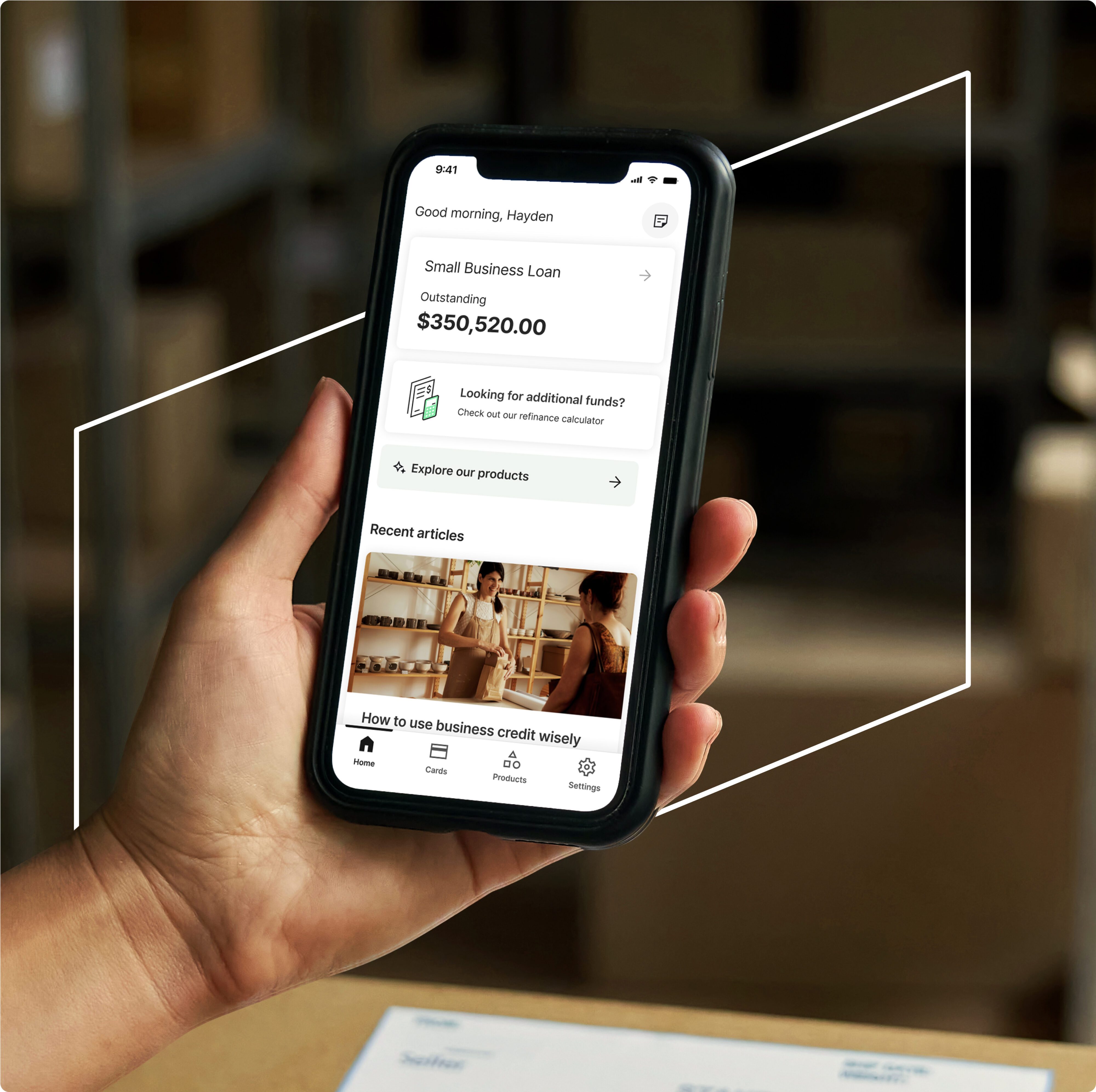

Small Business Loan

Borrow a lump sum of between $5K and $500K over a fixed term of up to 36 months. Great for buying extra stock or equipment, hiring casual staff or covering unexpected expenses.

- Fast decision with funding possible in hours

- Fixed repayments to help with budgeting

- No upfront security required to access up to $150K in Prospa funding

How our customers have put their funds to work

Read customer storiesEasy application

Apply online in under 10 minutes with minimal paperwork.

Flexible terms

We offer repayment terms of 3 - 36 months, with the freedom to pay out your loan early and save on interest

Custom pricing

Our rate is determined by how much you're borrowing, the size of your business and credit score.

*YouGov Research SME Sentiment - prepared for Prospa, October 2023.