Business Finance Loan

If you’re a small to medium-sized business owner looking for a business finance loan, it is worth doing your research so you get the right loan for your needs. Thankfully, the days of rigid repayment rules and drawn out decision-making are long gone. When applying for a business finance loan, an online small business lender like Prospa can offer you a hassle-free application process and fixed repayments so you always know where you stand.

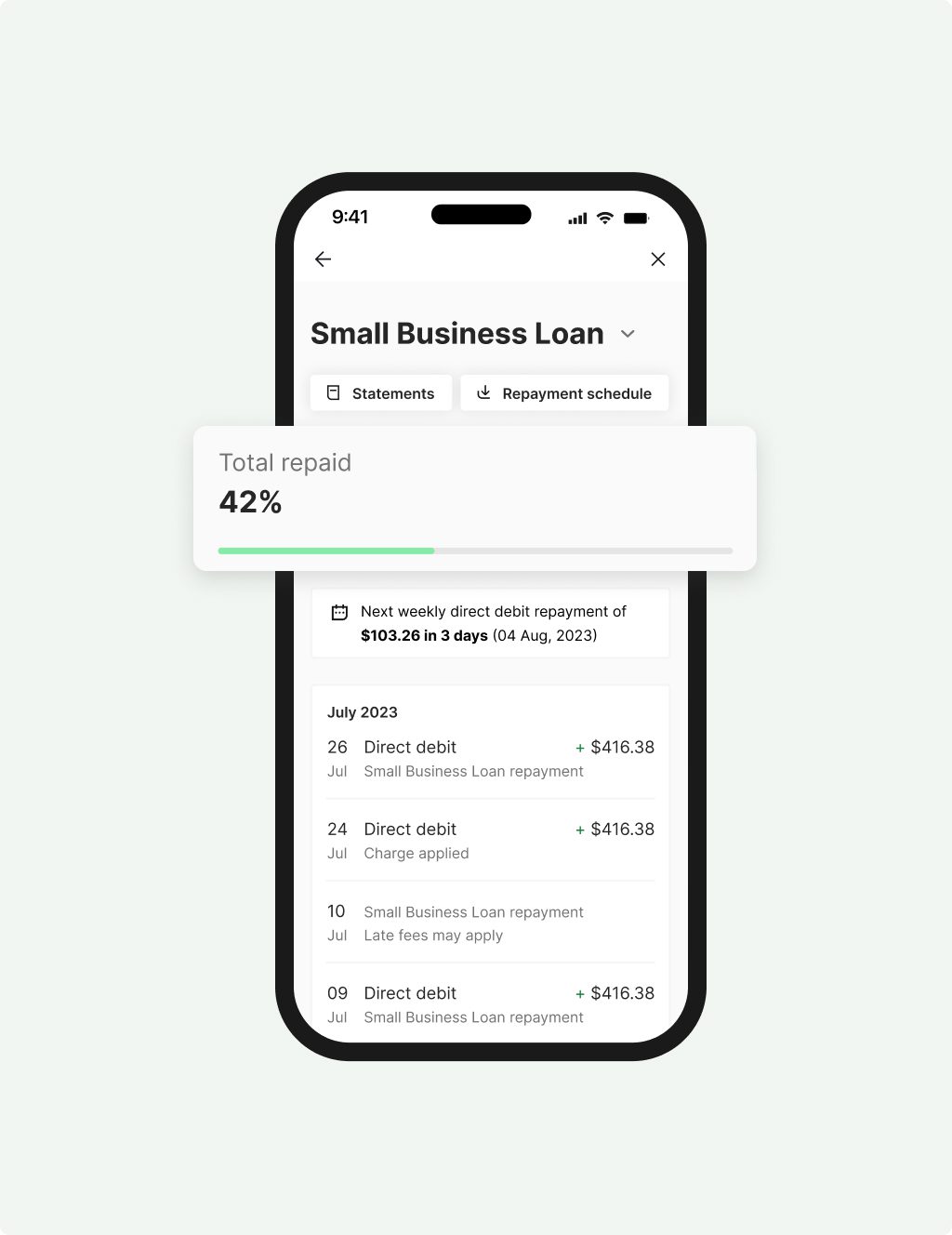

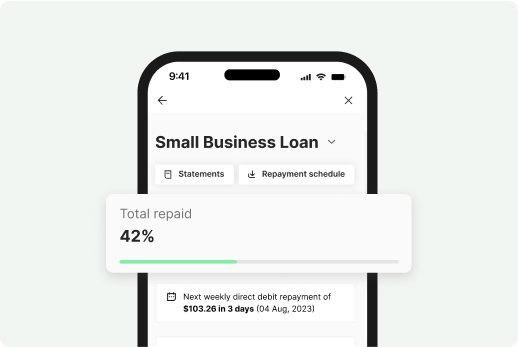

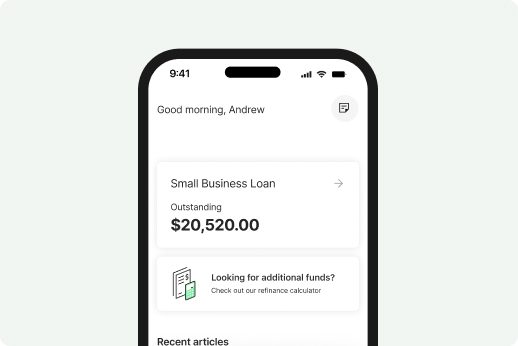

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

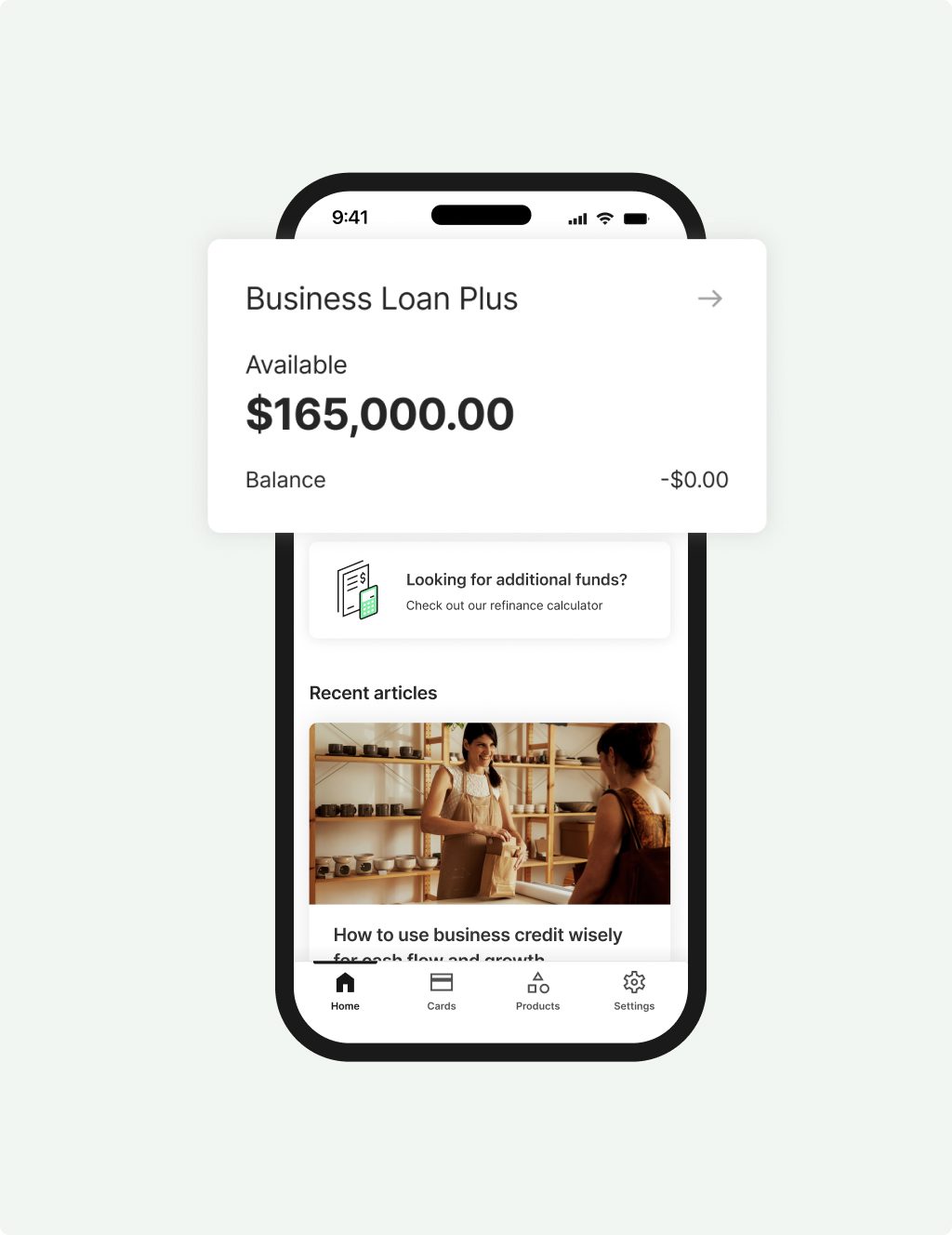

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

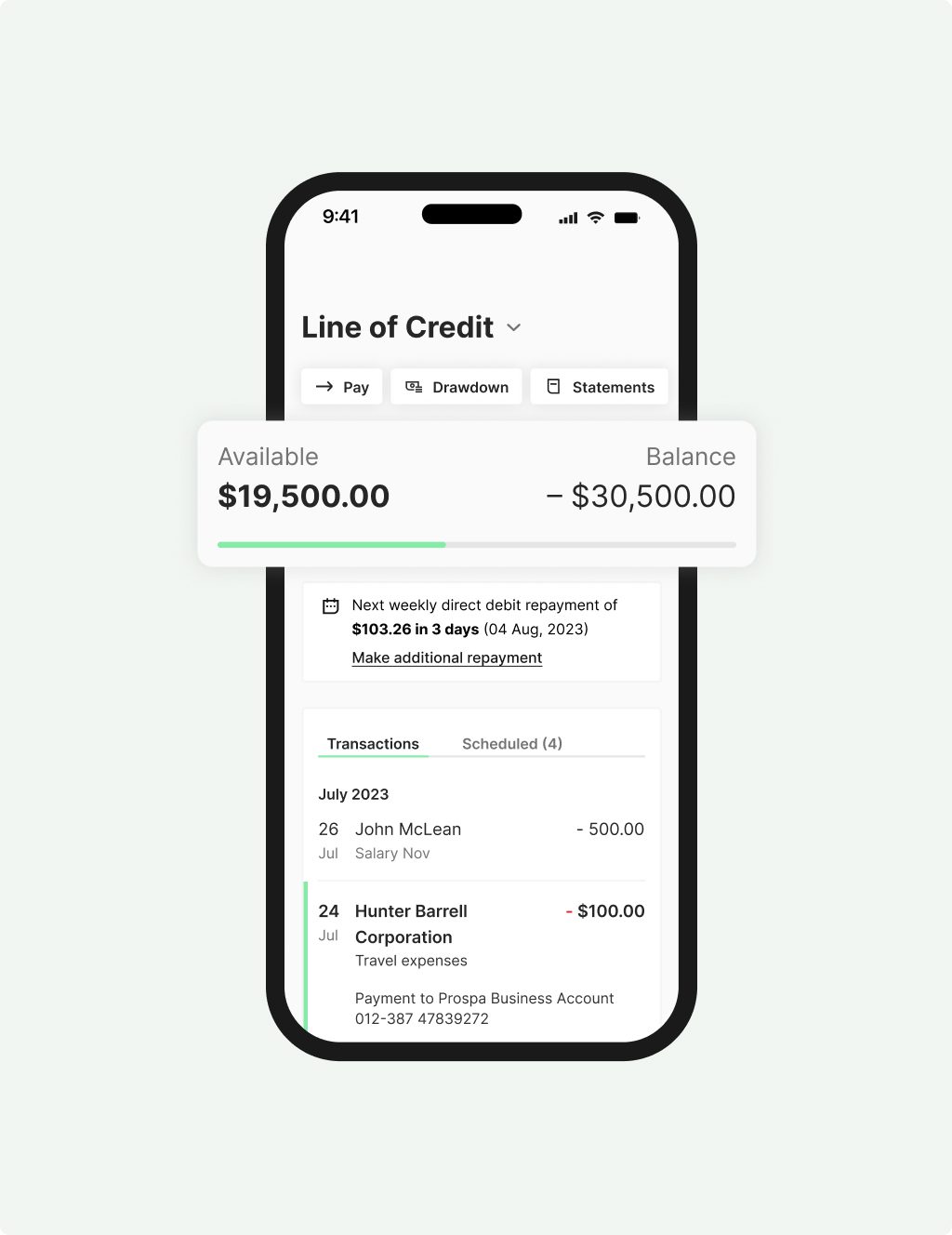

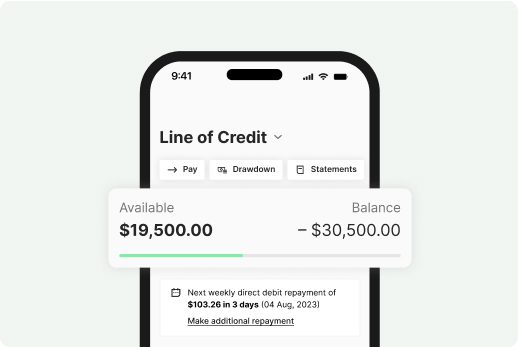

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Finding a business finance loan that’s right for you

Our friendly and dedicated customer service team take the time to understand your business and help you find a funding solution that best suits your business needs. We offer a hassle-free and fast application process that can be completed in as little as 10 minutes without any confusing jargon. Our decision-making process is also quick, with funding possible in just 24 hours.

You’ll also benefit from a fixed weekly repayment schedule. Plus there are benefits to paying the loan out early.

Australia’s #1 online lender to small business

When you apply for a hassle-free business finance loan from Prospa, you’re joining our growing list of small businesses across Australia that have benefited from our support. Contact us to find out more about accessing funding between $5K and $1M.

With 6,600+ reviews on Trustpilot, our positive feedback speaks for itself! Read our customer reviews, stories, and testimonials online today.

More than just funding: Podcasts for small business owners

We provide loans that help small businesses thrive. We also create tools and support that help you run your business – just like this list of 6 podcasts business owners are listening to now (+2 they should be). These podcasts cover everything from how-to guides on business strategies to practical marketing tips and more. Listen now and be inspired! For more helpful articles, check out our blog.

Business finance loans made easy

Match your business needs with one of our flexible small business loans up to $1M You can choose from two business loans:

- The Prospa Small Business Loan is great for one-off purchases and gives you access to $5K–$500K with terms up to 5 years. (Plus, there’s no upfront security required to access up to $150K of Prospa funding.)

- The Prospa Plus Business Loan offers between $500K and $1M, perfect for growing your business.

As an alternative to a business loan, we also offer a business line of credit with limits up to $500K. It’s like having funds on hand when you need them to support day-to-day business cash flow.

Our flexible funding solutions are available to support a wide range of different business needs. With our fast decision-making process, funding may be possible in 24 hours.

How to get the most out of your business finance loan

There are many ways your small business could benefit from a business finance loan. Use your loan to purchase equipment, diversify your offerings or enter a new market. Whether you need a short-term or long-term loan between $5K and $1M, our business lending specialists can help you find the best business loan for your needs. Extra funds could be just what you need to allow your business to thrive.

Eligibility criteria for a business finance loan

To qualify for a Prospa business finance loan, applicants must be

- either an Australian citizen or a permanent resident;

- over 18 years old; and

- and have a valid ABN/ACN.

To apply for business loans up to $500K, you’ll need a minimum $6K monthly turnover and minimum trading history periods apply. For larger loans of $500K–$1M, you’ll need a minimum annual turnover of $2M and 3 yearss trading. We’ll also look at the creditworthiness of your business before issuing a loan.

Flexibility

Support

Confidence

FAQs

FAQs

Some commercial loans require a deposit. And while you don’t need a deposit to apply for funding with us, however it is a good idea to have a clear understanding of all of your finances before you apply.

It’s OK if you don’t have pages and pages of financial analysis to reference. We understand that small business operators are up against it and often struggle to keep up with the paperwork.

You can choose to repay the entire amount of your loan early at any time.

If you decide to do this please speak to our friendly business loan specialists on 1300 882 867. They will provide you with repayment details and an early payout figure. This will be calculated as the total of the remaining principal amount and any accrued interest at the date of early payout, plus 1.5% of the remaining principal and any outstanding fees.

In additional to your weekly repayments, you can choose to make unlimited extra repayments with no extra cost. Any extra repayments on your business loan will help you to pay off your loan faster and save on interest.

Awards, thanks to your support

It's nice to know we're doing something right

| Year | Award | Category |

|---|---|---|

| 2024 | Great Place to Work | Certified |

| 2025 | Great Place to Work | Recognised as one of Australia’s Best Workplaces for Women |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |