The importance of managing your cash flow

The money flowing in and out of a business, also known as business cash flow, is like the lifeblood of a business. Many business owners report cash flow as one of their main concerns. In fact, studies show that more than 60% of small businesses in Australia stop operating within the first three years, and many of these failures are due to poor management and inadequate business cash flow.

A healthy balance sheet relies on a constant stream of cash coming into the business to maintain positive cash flow so that bills can be paid. Because not all businesses have a sizeable cash reserve to use as working capital, business cash flow often relies primarily on staying on top of accounts receivable. When business cash flow is disrupted, many businesses experience stress.

Maintaining business cash flow

Maintaining a positive cash position relies on having an effective accounting system in place. This includes decent accounting software that provides access to a cash flow statement so the business owner can conduct an analysis of the business’s financial position over the short term and long term. It also allows the business owner to plan ahead for growth, setting targets and monitoring company performance, and being comfortable with risk management.

Find out more about how to overcome business cash flow crunch in this article.

Get cash flow support

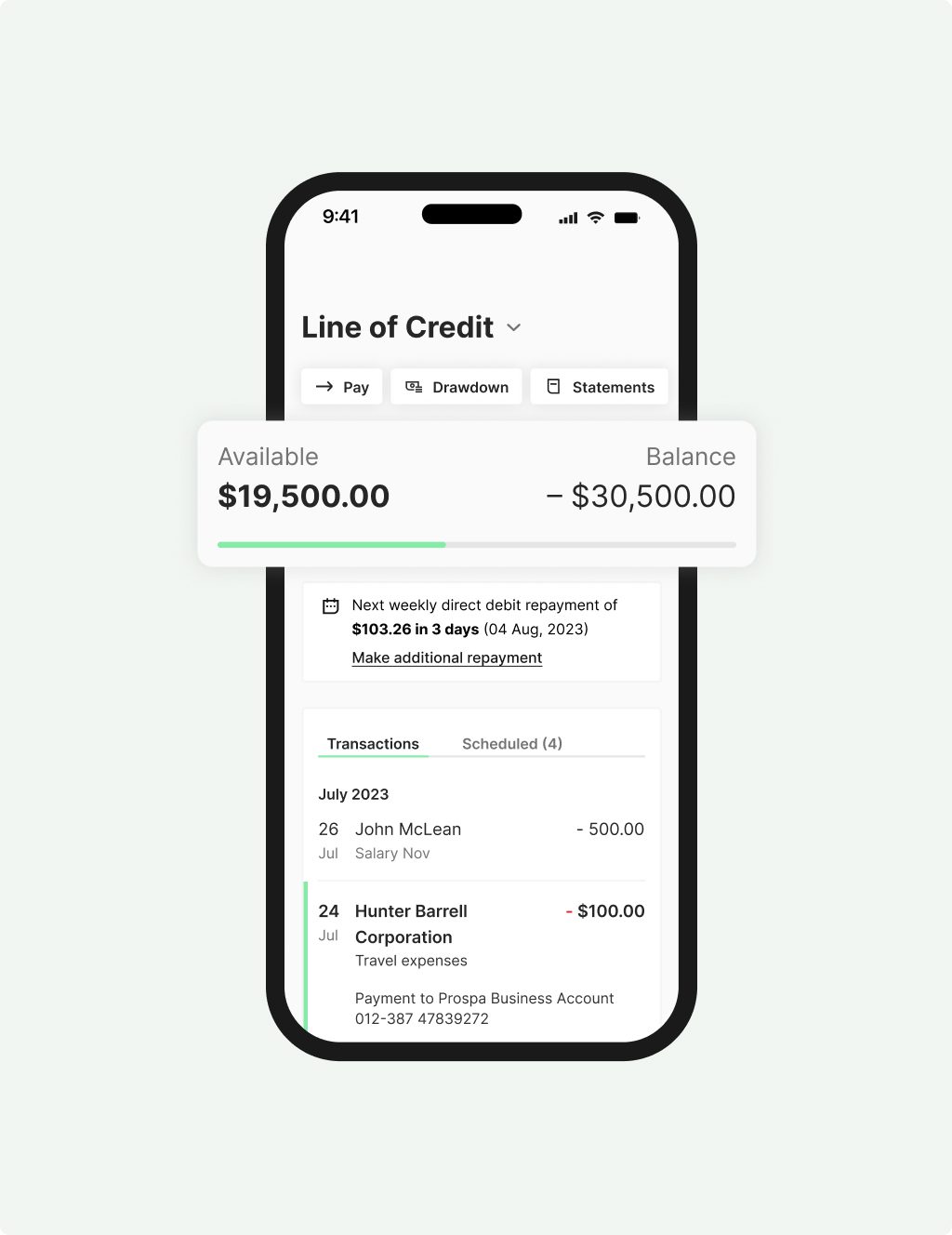

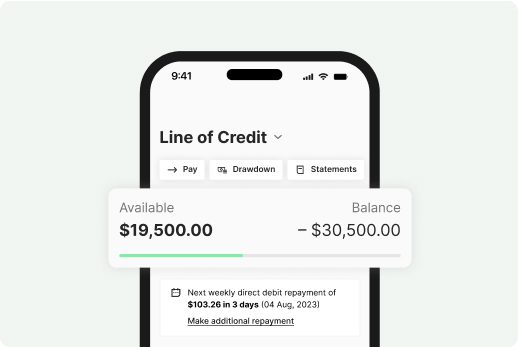

If you’re looking for a handy way to support all different types of cash flow fluctuation, the Prospa Business Line of Credit can help with ongoing access to funds (up to an approved limit) that you can use and reuse as often as you need to.

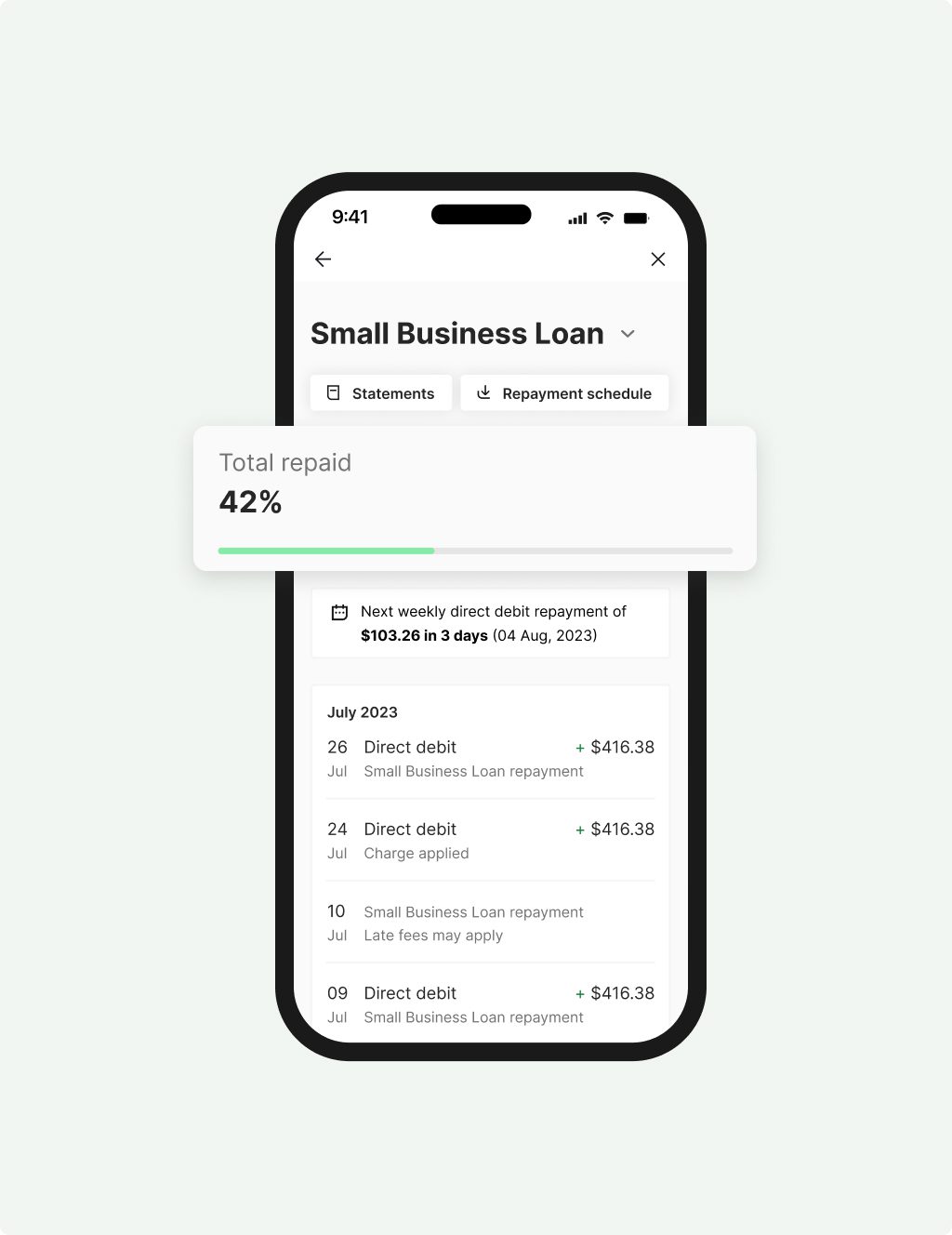

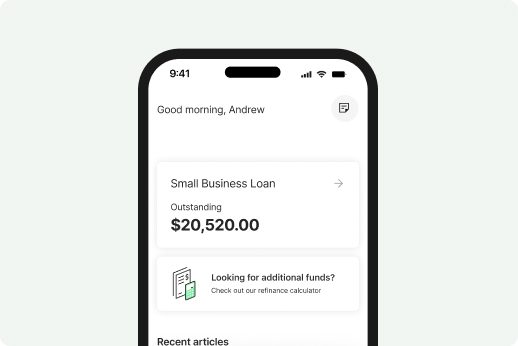

Alternatively, talk to us about a Small Business Loan if you need a lump sum of $5K to $500K.

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

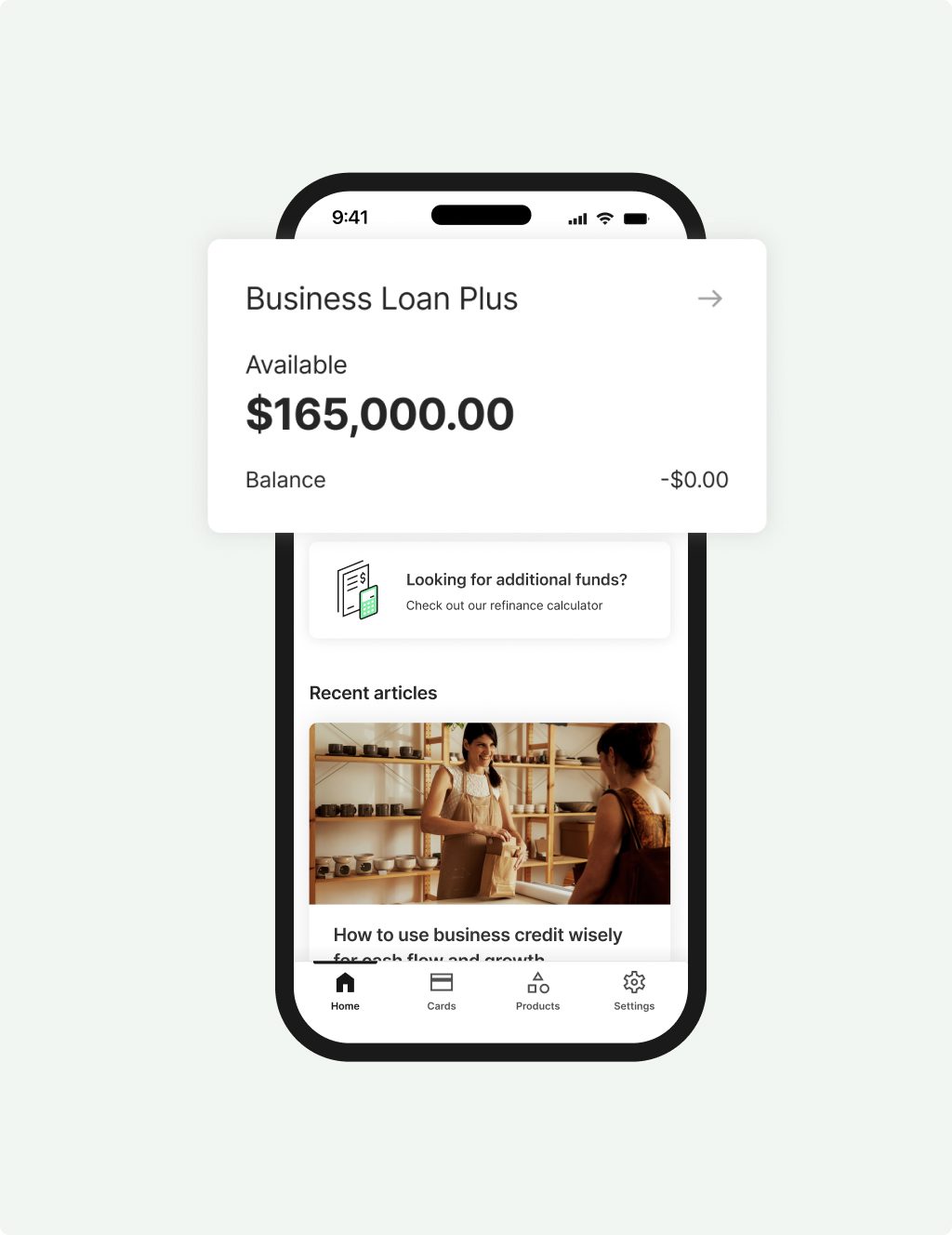

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Why Prospa? It’s today’s way to borrow.

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Choice

Borrow up to $1M with 10 minute application, fast decision and funding possible in 24 hours.

Support

Confidence

Why is business cash flow important to a small business?

Day to day expenses in a business are unavoidable. They include things like: staff wages, rent, utilities, phone, computer expenses, maintaining equipment, vehicles and machinery, furniture, insurances, office supplies, professional service fees, loan/lease payments, advertising and marketing costs, association fees, travel expenses, tax expenses and more.

Without the necessary working capital to cover these expenses a business can fall behind. So it’s incredibly important to stay on top of the numbers and keep an eye on what’s coming.

How do I keep track of business cash flow?

There are plenty of tools available to help, but why not start with this free cash flow forecast template. This ready-made spreadsheet will help you stay on top of your business cash flow and find out where your finances might need a boost.

How to increase the cash flow in your business?

If money flowing out of your business is faster than money flowing in, you need to take action. There are a number of things you can do in the short term that will make an almost immediate difference:

- Save money by cutting costs – Look at where you could be saving money in the business, cutting overheads and costs that aren’t essential to the running of the business. You may only need to do this in the short term to get you through a seasonal fluctuation – but it never hurts to do this anyway.

- Reduce stock on hand – The stock you have on your shelves or in the warehouse can be turned in to cash quickly through offering a range of discounts or by having a sale. You can also order less stock during times of fluctuating business cash flow.

- Talk to suppliers about payment terms – This isn’t ideal, but your suppliers may be happy to wait a little longer for your payments during times of cash flow crunch.

- Chase invoice payment – If you stay on top of your accounts receivable your customers are less likely to miss payments. You could also offer a small discount if they pay early or add new payment options to make it easier for them to pay.

- Delay expansion plans – Expansion can be a big expense without immediate gain. So if you are planning to expand, perhaps consider waiting until your business cash flow is in better shape.

- This article describes some of the common cash flow mistakes business owners should try to avoid.

Will growing my business increase business cash flow?

Growing your business is a longer term solution that can contribute to increased business cash flow. Business growth doesn’t necessarily mean a bigger premises or more customers, it can be as simple as making a small but significant change to existing processes. For instance you could update your website more often, invest in an online booking system, employ a good small business accountant, add a couple of extra tables to your restaurant, open longer hours, do a sales promotion or some marketing for your product or service, or even offer a discount for bigger orders.

This article explores some ideas about how as a small business owner you can grow your business and increase cash flow.