Bank loan for business

Are you thinking about ways you could grow your small business? You may need a bank loan for business to help you get things off the ground. However, there are alternatives you could consider to get the best option for your business.

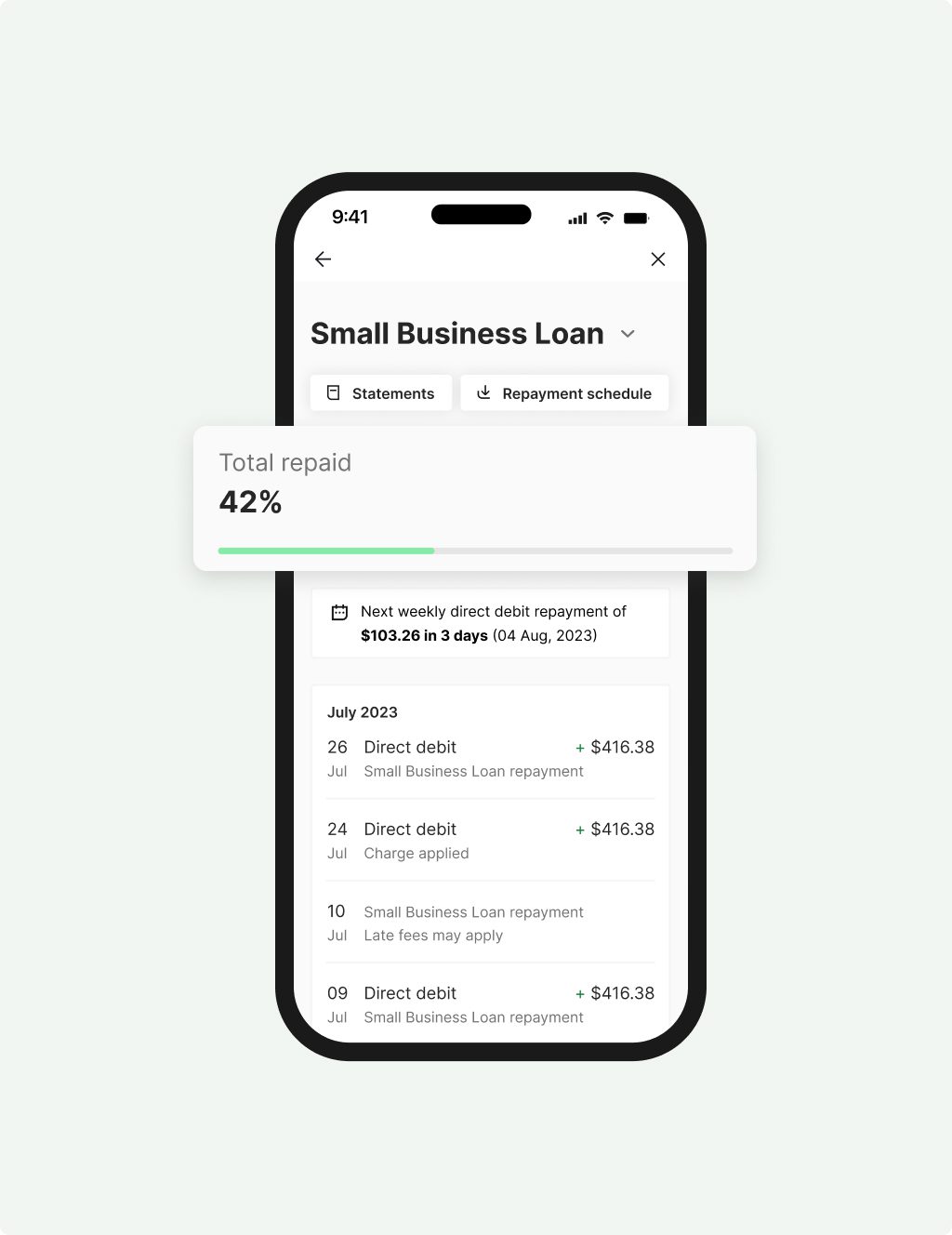

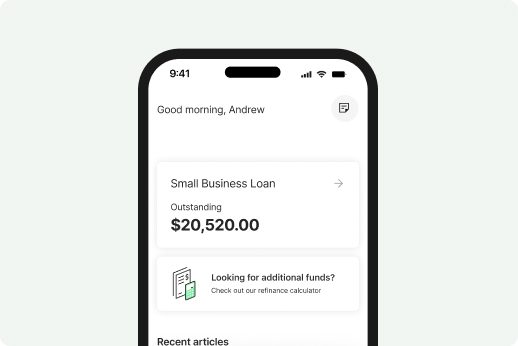

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

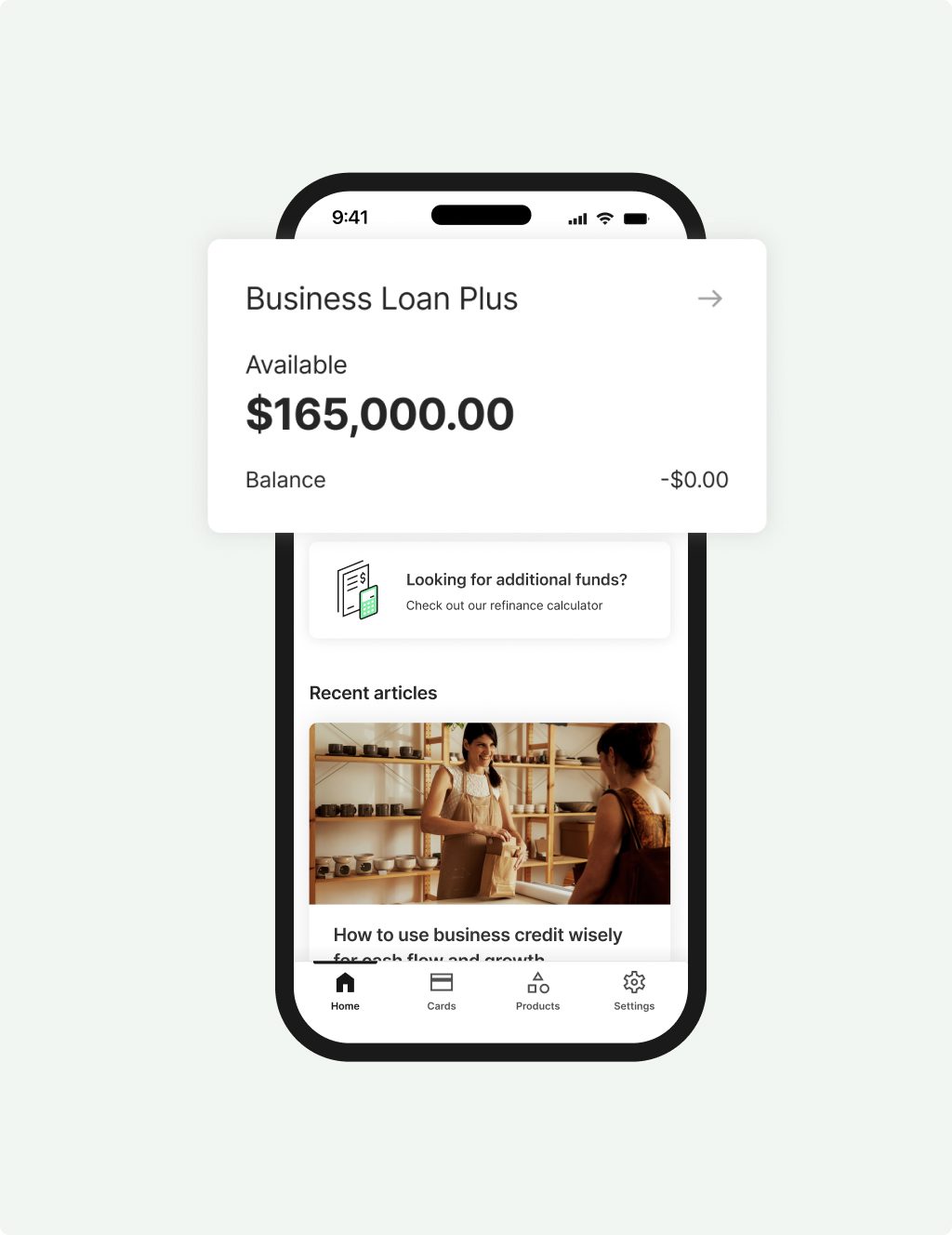

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

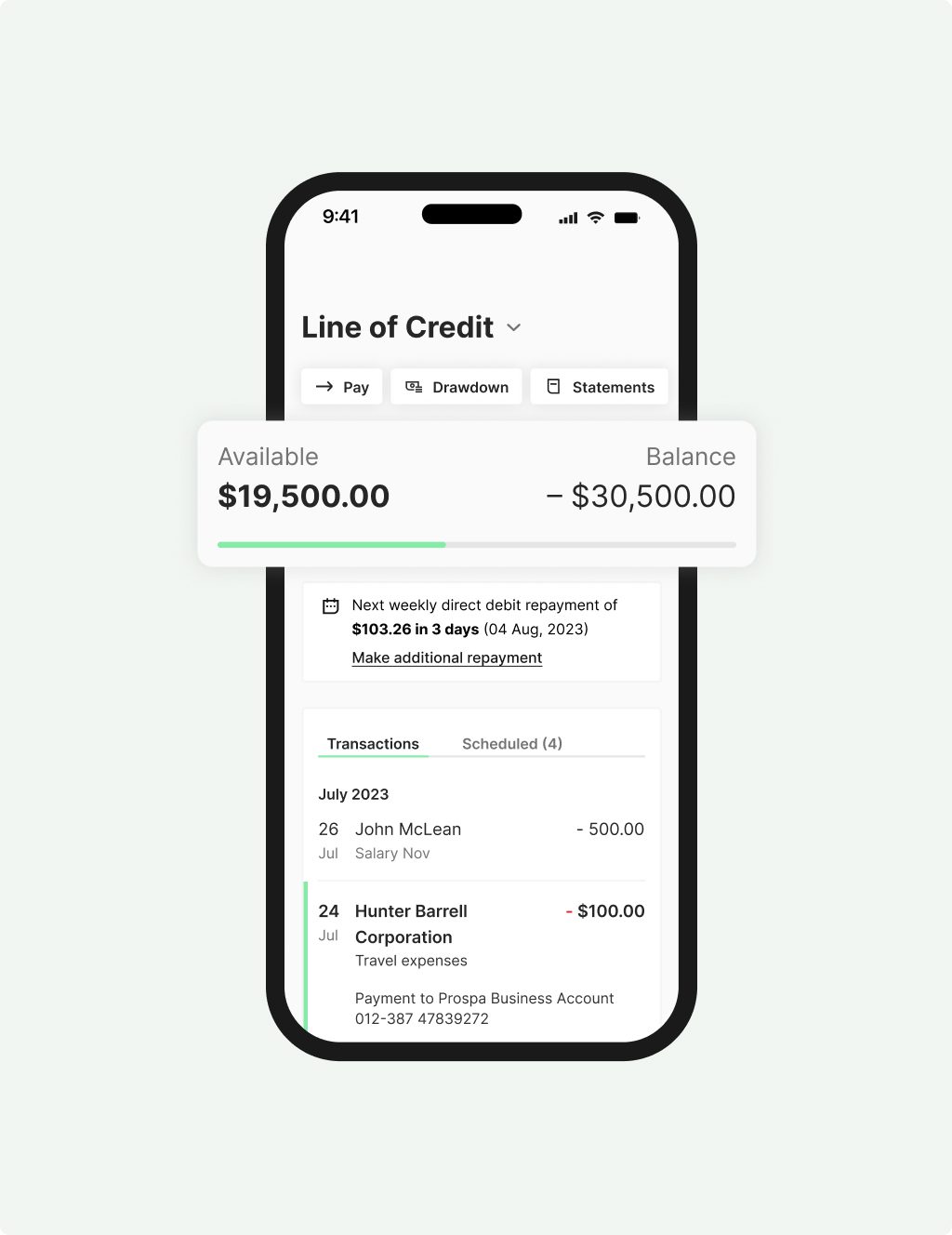

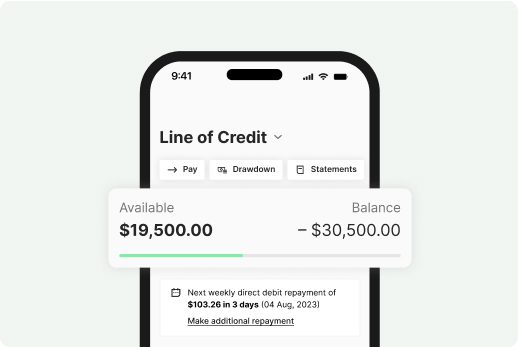

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Could Prospa offer the right small business loan for your business?

Whether you need a smaller amount of money for a one-off purchase or a larger amount to invest in your business, a Prospa business loan can give you quick access to $5K up to $1M. And with our straightforward application process, you can apply online in under 10 minutes with funding possible in 24 hours.

When you apply for a small business loan online with Prospa, our automated system will check your eligibility in real-time. If approved, the funds can be deposited into your nominated bank account as soon as the next business day.

Australia’s #1 online lender to small business

If you are applying for a bank loan for business or any other small business funding, ensure you select a lender you can trust. If you are seeking funding to act as a commercial loan with Prospa, you’ll be joining thousands of other businesses who have thrived with our support.

You don’t have to take our word for it, check out our 6,600+ reviews on Trustpilot and find out what our customers are saying.

Find out more.

What Aussie small to medium businesses are investing in

Although times have been tough for some small to medium businesses (SMBs) over the last couple of years, it is definitely not all doom and gloom. In fact, in a recent survey of SMBs, almost all respondents said they would recommend starting a small business to others and agreed that Australia is a great place to be an SMB owner. From rebranding and creating a new website to developing custom digital platforms, offering new services, and more, find out what 7 SMBs are investing in now and why.

If you are looking for stories, articles, tips, and tools designed to keep your small business moving, head to the Prospa blog for more inspiration.

Loans for business made easy

If you are looking for a bank loan for your business, consider Prospa. We offer hassle-free small business funding. Whether you need quick access to $10K to cover costs or $400K to invest in your next business growth opportunity, our loans for business have you covered:

Prospa Small Business Loan

- Quick access to $5K–$500K with a decision in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Term up to 5 years

- Minimum 6 months trading and $6K monthly turnover to apply

Prospa Plus Business Loan

- Access to larger loans of $500K–$1M

- Upfront security required

- Term up to 60 months

- Minimum 3 years trading and $2M monthly turnover to apply

- Dedicated business lending specialist

Another alternative to a bank loan for business is a line of credit. Prospa offers a line of credit with limits up to $500K. It’s another great way to support your day-to-day business cash flow. Find out more here.

What business funding could do for your business

There are many reasons you might want to apply for a bank loan for your business:

- expand your business

- purchase extra inventory

- boost your marketing strategy

- do some renovations

- improve your business cash flow.

As an alternative to a bank loan for business, a Prospa small business loan can also be used for a wide range of business purposes.

Whether you need $5K for a new photocopier and printer or $1M for some major office renovations, Prospa has you covered. Having access to competitive business funding when you need it can not only help you weather anything that comes your way but investing in your business can really make it thrive.

Is your business eligible for a Prospa loan?

To be eligible for an SME business loan from Prospa, you need to fulfil the following conditions:

- be over 18 years of age;

- be an Australian citizen or permanent resident; and

- own an Australian business with a valid ABN/ACN.

To apply for a loan between $5K and $500K, you’ll also need minimum $6K monthly turnover and minimum trading history applies. To apply for larger loans of $500K–$1M, you’ll need a minimum $2M annual turnover, 3 years trading, and upfront asset security.

Talk to Australia’s #1 online lender to small business

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Flexibility

Support

Confidence

FAQs

FAQs

For all Prospa funding:

- Business owners must be 18+ years

- Business owners must be an Australian citizen or permanent resident

For a Small Business Loan up to $500K, you must also have:

- From 6 months trading history

- Monthly turnover of $6K

For a Business Line of Credit up to $500K, you must also have:

- Minimum 6+ months trading history

- Monthly turnover of $6K

- Property or asset ownership

For a Business Loan Plus from $500K up to $1M, you must also have:

- Minimum 3 years trading history

- Annual turnover of $2M

- Property or asset ownership

We offer Business Loans up to $1M or Line of Credit up to $500K, however the total amount of your loan will depend on the specific circumstances of your business.

We consider a variety of factors to determine the health of your business and based on this information we will make an assessment on how much you can borrow.

Use our loan calculator to discover much you could afford to borrow.

The application process is easy and fast. Simply complete the online form in as little as 10 minutes. If you are applying for $250K or less, you need:

- Your driver licence number

- Your ABN

- Your BSB and account number

- Minimum trading history applies

Other questions?