Let's make business happen

Find, connect and win more business

Micro Small

Business

Emerging Small

Business

Established Small Business

Small business eligibility criteria

Unlock a new tier of pricing

| Micro and Emerging Small Businesses | Established Small Business | |||

| Turnover | > $6K per month, on average | > $100K per month, on average | > $300K per month, on average | > $700K per month, on average |

| Time trading | > 6 months | > 2 years | > 3 years | > 3 years |

| Credit score | – | > 550 | > 650 | > 650 |

| Account conduct | Good | Excellent | Excellent | Excellent |

| Documents | > 6 months Bank Statements | > 6 months Bank Statements | > 6 months Bank Statements | > 6 months Bank Statements |

| Rates (Annual Percentage Rate) | From 29.95% (APR) | From 23.95% to 24.95% (APR) | From 19.95% to 20.95% (APR) | From 17.95% (APR) |

| Rates (Annual Simple Rate) | Estimated from 15.99% (ASR) | Estimated 12.65% to 14.05% (ASR) | Estimated 10.47% to 11.60% (ASR) | Estimated 9.39% to 9.80% (ASR) |

| Building & Trade | From 29.95% (APR) | From 20.00% (APR) or from 10.49% (ASR)* | From 20.00% (APR) or from 10.49% (ASR)* | From 20.00% (APR) or from 10.49% (ASR)* |

The alternative lender of choice

Speed

Applications in under 10 minutes, quick decisions and funding possible in hours.

Flexibility

Repayment terms between 3-36 months with the freedom to make extra repayments and pay out their loan early to save on interest.

Support

Our locally focused BDMs are here to help you confidently find the SME opportunities with greater transparency and clarity

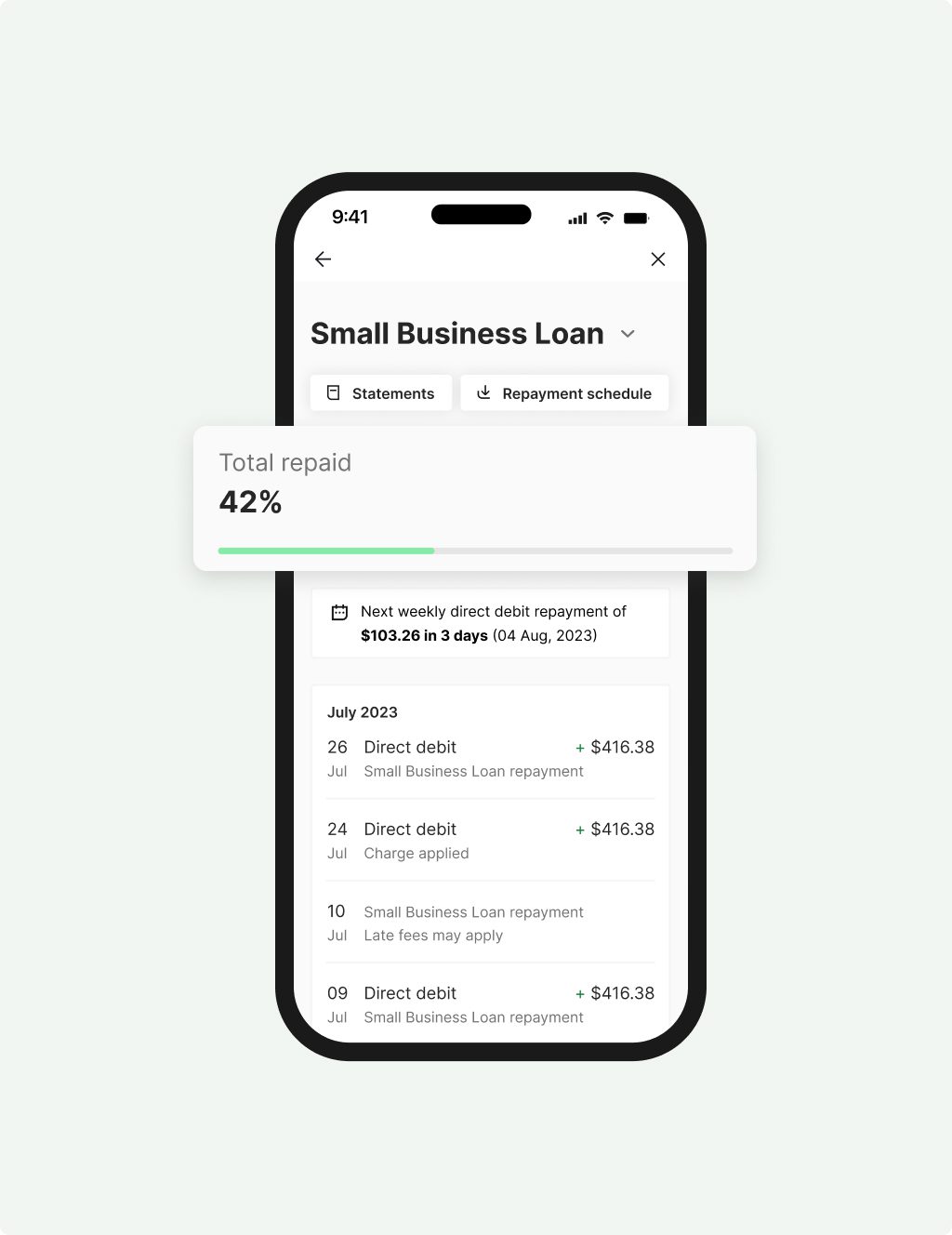

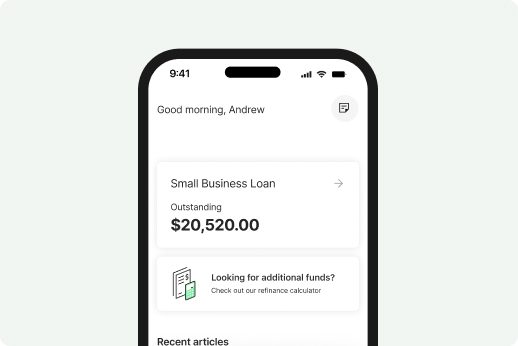

Prospa Small

Business Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 24 months with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $5K monthly turnover and 6 months trading to apply

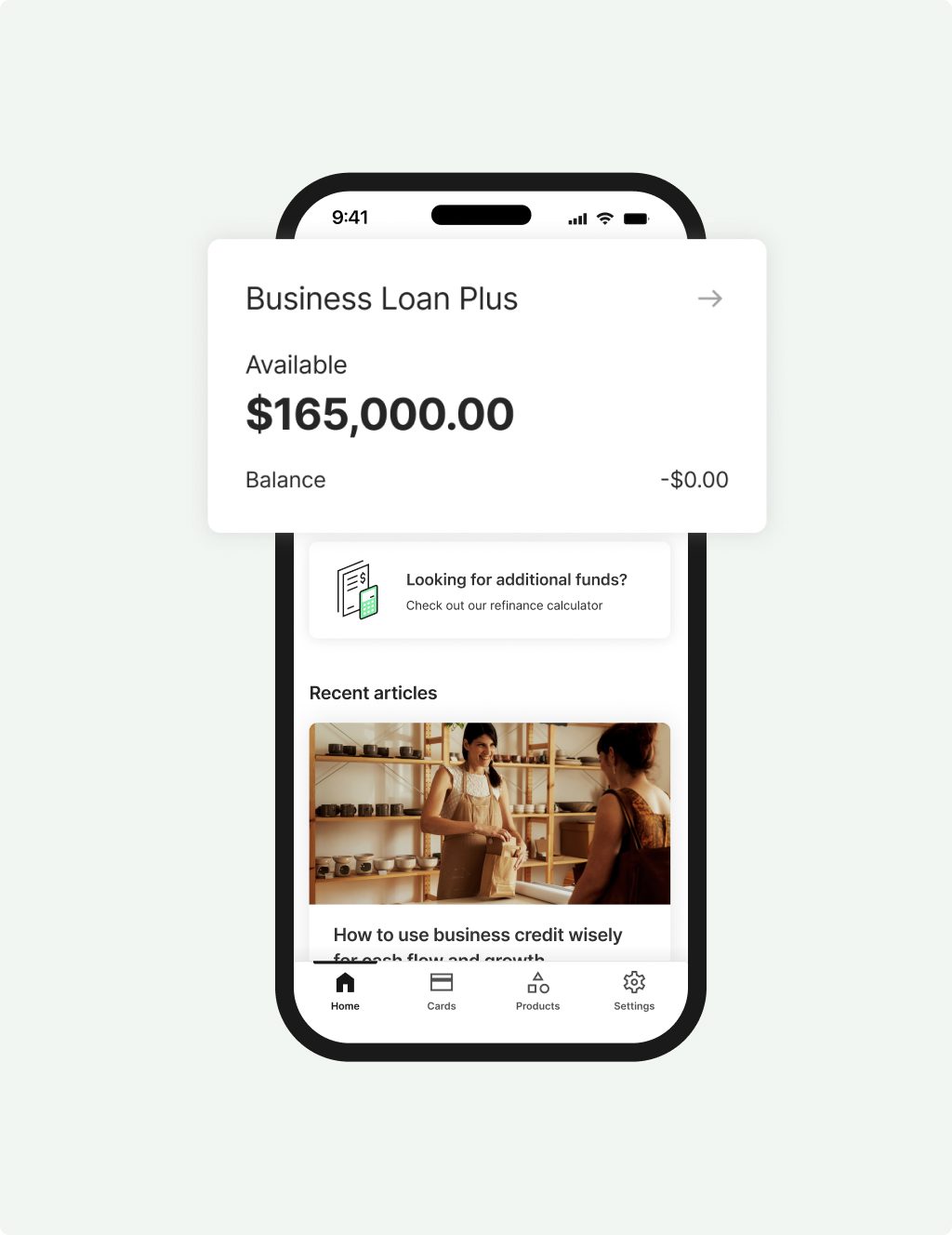

Prospa Business

Loan Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 36 months with fixed rates

- Dedicated Business Lending Specialist

- Upfront asset security required; charge over the applying business entity(ies)

- Minimum $1M annual turnover and 3 years trading to apply

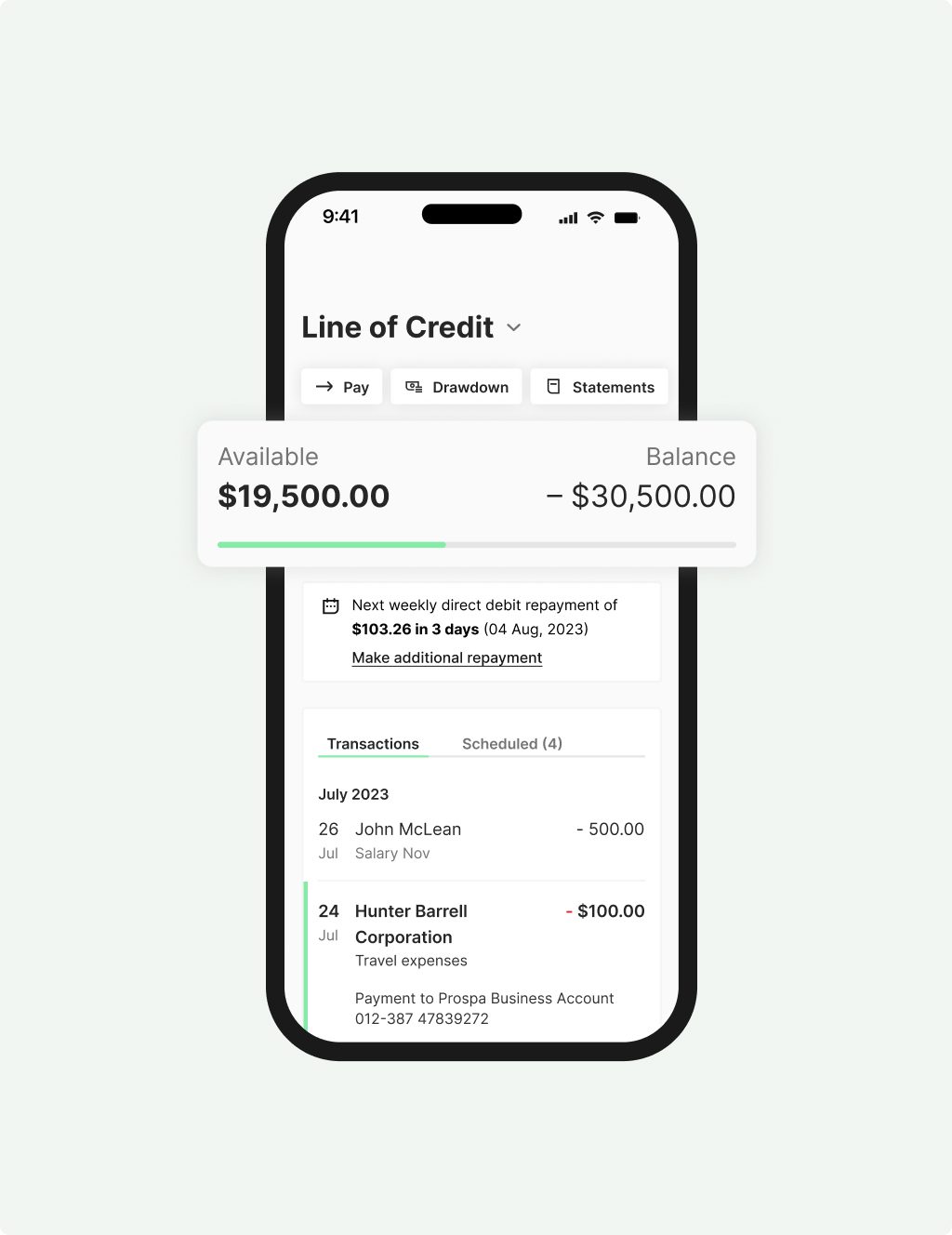

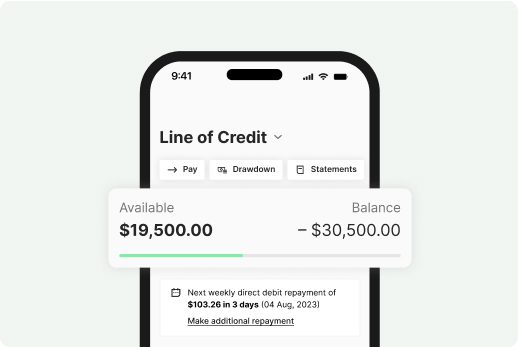

Prospa Business

Line of Credit

Ongoing access to up to $150K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $5K monthly turnover and 6 months trading to apply