Attract customers by taking business ‘online’

Flexible funding solutions to help you:

- Invest in your website and online capabilities

- Optimise touchless digital interactions

- Improve customer experience and satisfaction

Flexible business funding to get you online sooner

Aussie pub, restaurant and café owners have shown true resilience and flexibility through incredibly tough times. That’s why at Prospa we’re proud to have helped hundreds of them with funds to streamline sales processes, stand out from competitors and boost customer loyalty.

Sharpen your approach with no-nonsense business lending from Prospa up to $1M. It takes just 10 minutes to apply online and funding is possible in 24 hours if you’re approved. What are you waiting for?

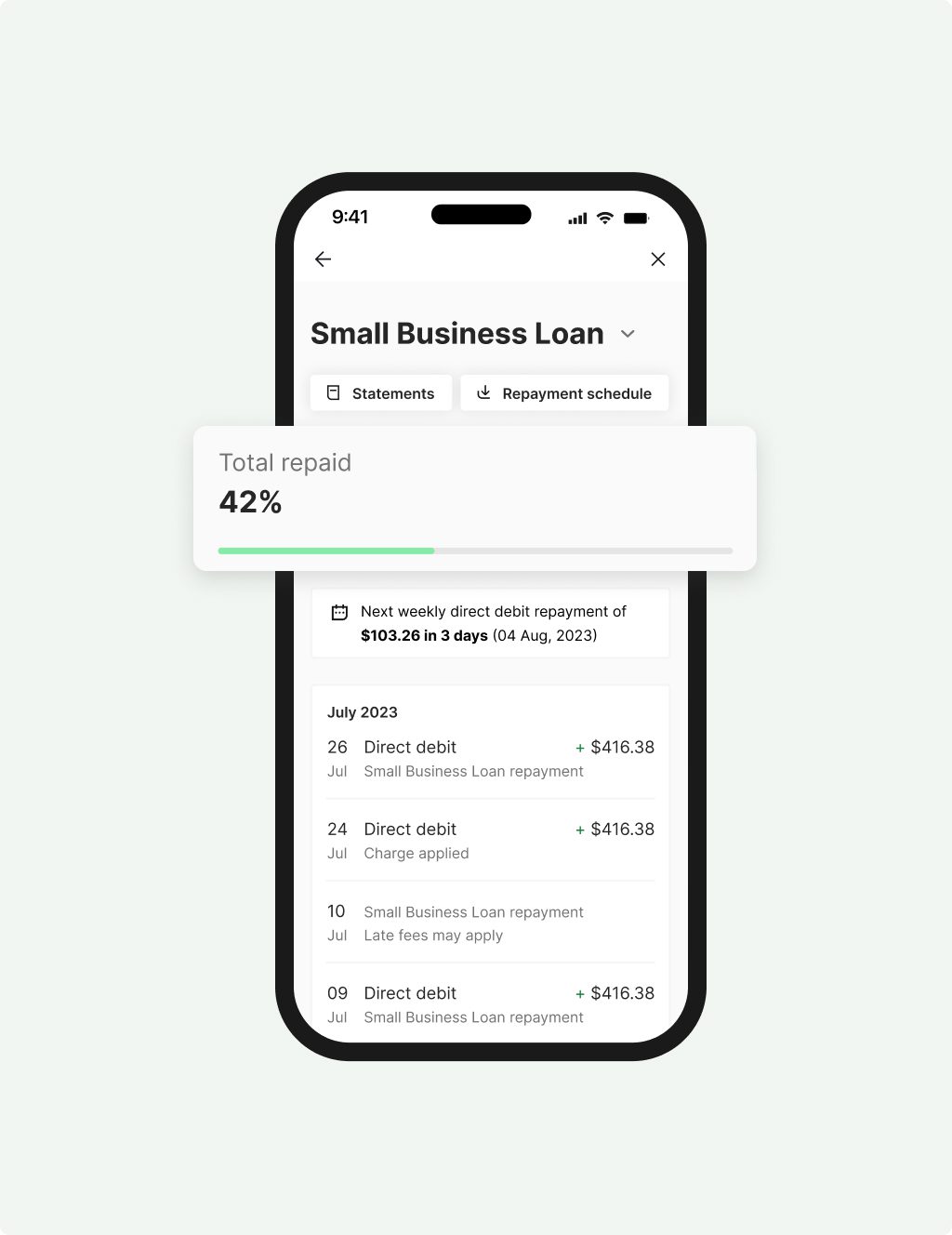

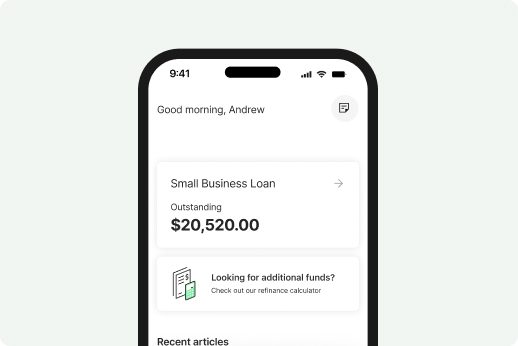

Small Business

Loan

Quick access to $5K – $500K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No upfront security required to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

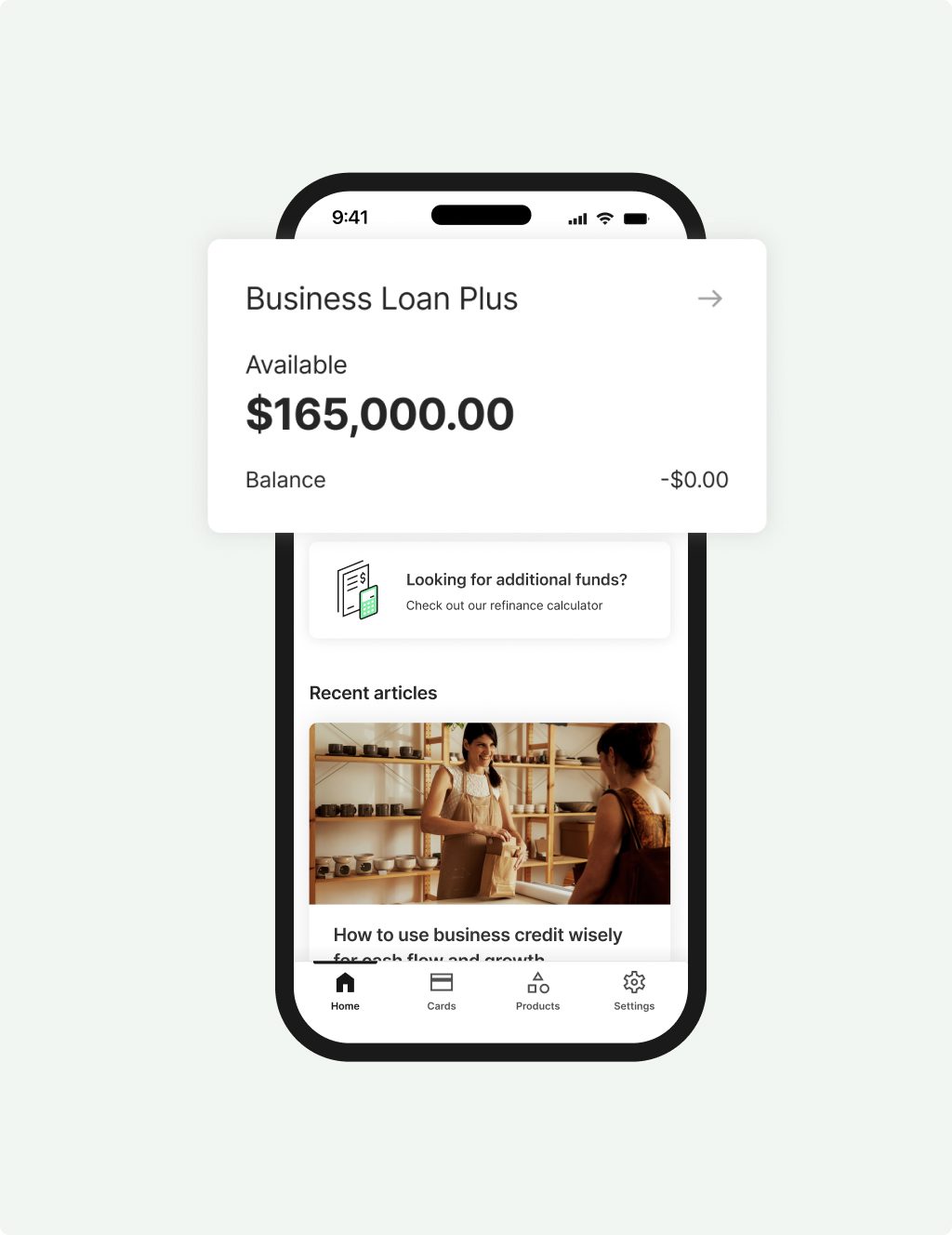

Business Loan

Plus

Larger loans above $500K and up to $1M to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $500K in Prospa funding

- Minimum $2M annual turnover and 3 years trading to apply

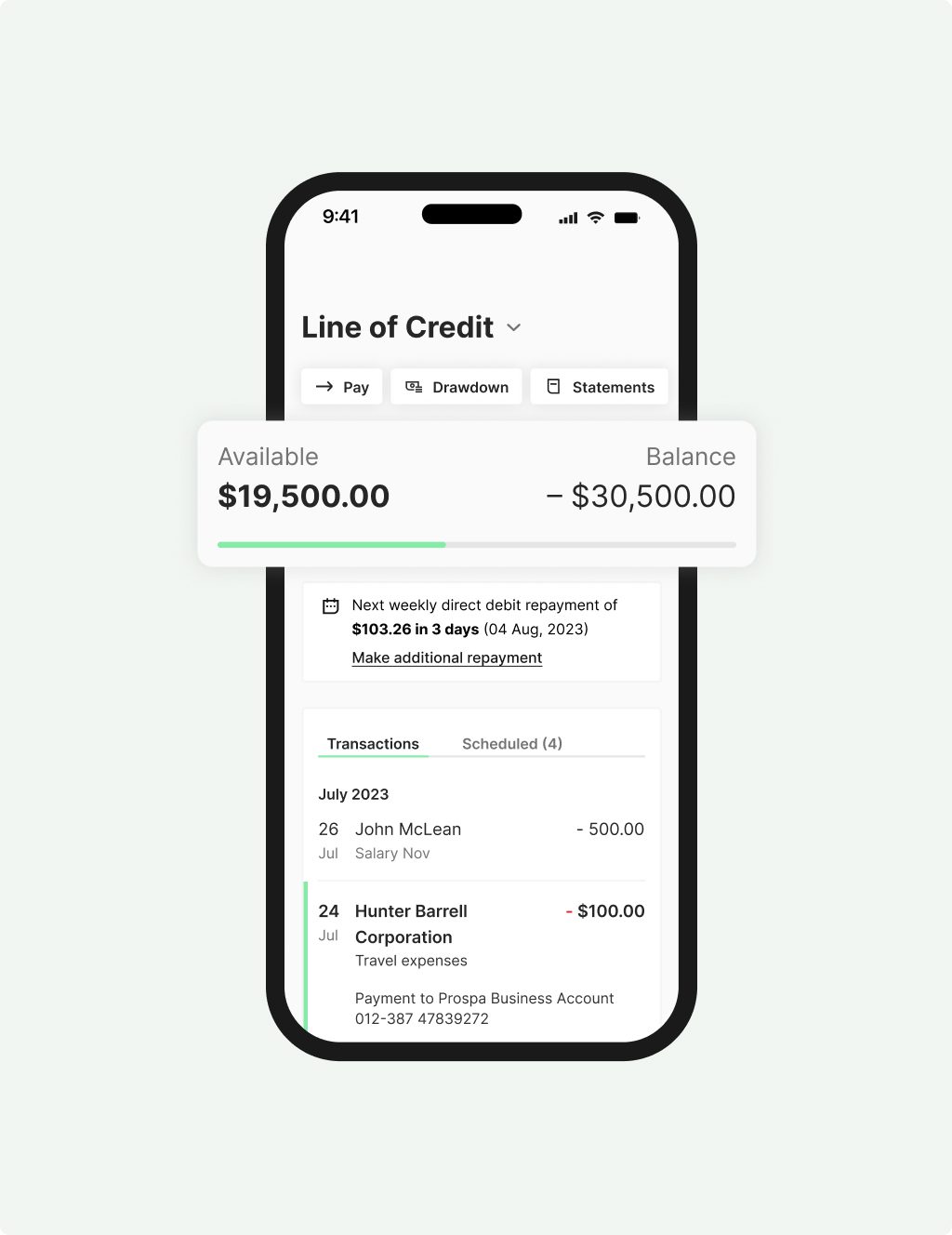

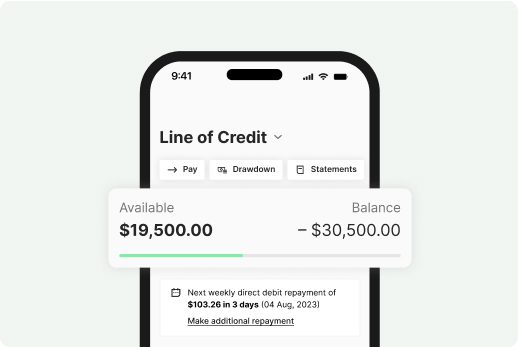

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and minimum 2 years trading history to apply

Cashflow or Growth. We help hospitality businesses with both!

As a business owner, you know that cash flow can play a vital role in your business’s day-to-day. Plus, there are times when you might need funds to invest in your business to take it to the next level.

Whether you’re a café, restaurant, pub or other hospitality provider, talk to Prospa about our flexible funding options. We can help you apply for the right option for your business’s needs – whatever they may be.

- Equipment. A new oven, a commercial fridge, a deep fryer – these things don’t always come cheap. Upgrade and enjoy the efficiencies.

- Expanding. Move to a bigger location, expand your current location or take on another site. Growth doesn’t have to stop here.

- Marketing. Create awareness, foster loyalty and acquire more clients through advertising, building a website or investing in social media.

- Pay wages and suppliers. Pay suppliers on time, cover staff wages, hire casuals during busy periods, pay for training.

- Remodelling. A lick of paint, some new outdoor furniture or a full location refit, your business office has never looked so amazing.

- And more. Having hassle-free access to funding can help give hospitality business owners the freedom to move quickly.

Resources for the Hospitality industry

Awards, thanks to you

It’s nice to know we’re doing something right.

| Year | Award | Category |

|---|---|---|

| 2024 | Great Place to Work | Certified |

| 2025 | Great Place to Work | Recognised as one of Australia’s Best Workplaces for Women |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best short-term loan |

| 2024 | FINNIES Fintech Australia Awards | Finalist, Excellence in Business Lending |

| 2024 | The Adviser Magazine's Product of Choice: Non-Banks Survey | Winner, Best SME loans less than $250K |