Need funds this EOFY?

Whether you're taking advantage of tax deductions, supplier sales, or gearing up for the new financial year - we've got your back with our limited-time offer.

Enjoy no repayments on business loans for the first 6 weeks.

Key features of our business loans:

- Funding up to $500K

- Easy online application

- Fast approvals with funding possible in hours

- Fixed term up to 36 months

Benefits of applying for a loan around tax time?

Inventory purchases

- EOFY supplier sales.

- Buy discounted stock in bulk.

- Place orders ahead of potential price increases.

Equipment purchases

- Taking advantage of instant asset write offs and tax deductions.

Planning for the new year ahead

- Reflect on the past years cash flow.

- Consider how extra funds could impact day-to-day cash flow and long-term profitability.

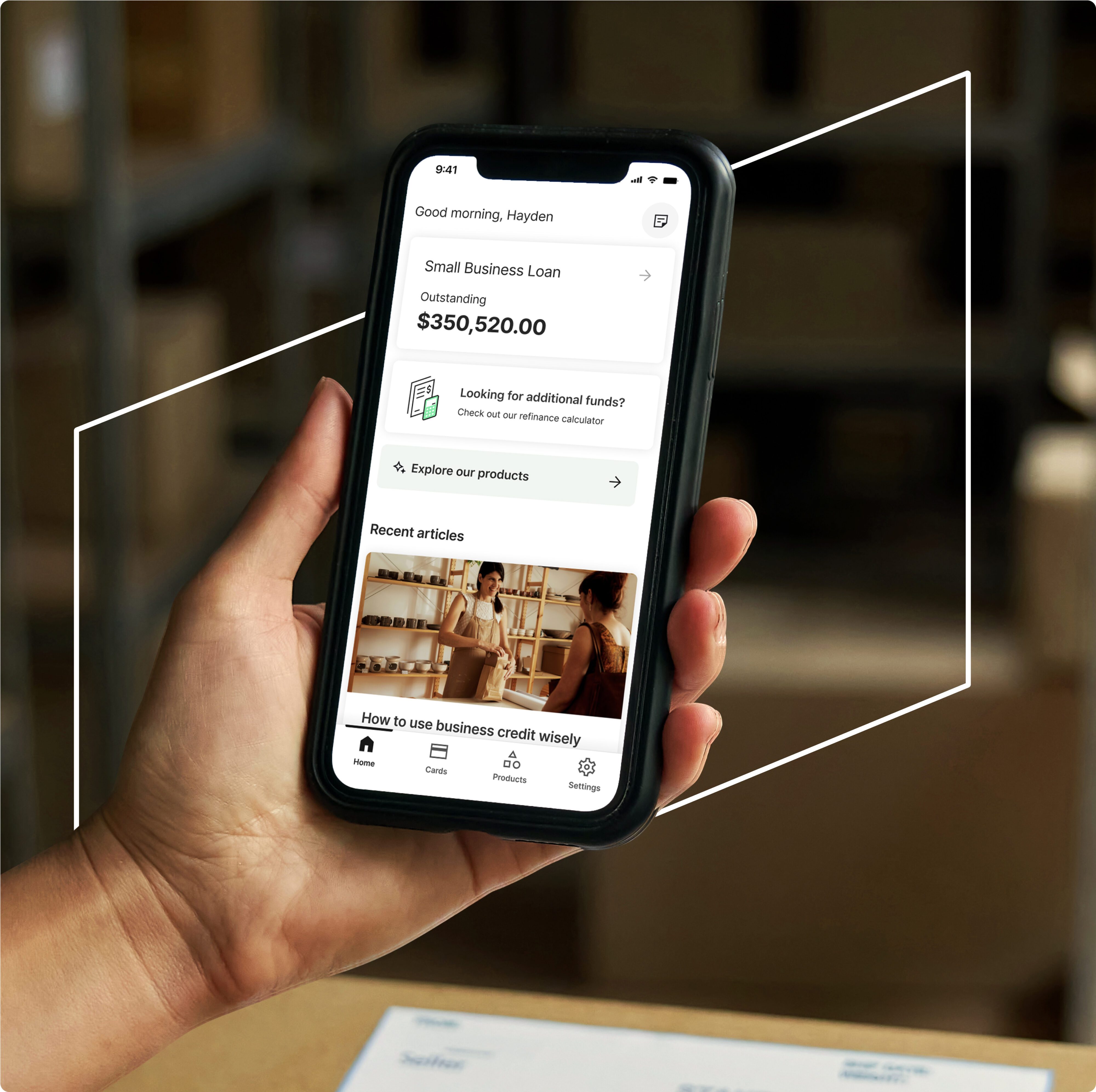

Small Business Loan

Borrow a lump sum of between $5K and $500K over a fixed term of up to 36 months. Great for buying extra stock or equipment, hiring casual staff or covering unexpected expenses.

- Fast decision with funding possible in hours

- Fixed repayments to help with budgeting

- No upfront security required to access up to $150K in Prospa funding

Customers making it happen with a Prospa loan

Read customer storiesFAQs

Common answered questions

The application process is easy and fast. Simply complete the online form in as little as 10 minutes. If you are applying for $150,000 or less, you need:

- Your driver licence number

- Your ABN

- Your BSB and account number

- Minimum trading history applies

How fast will I get a decision?

Under normal circumstances, we can often provide a response in one hour – as long as you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements we can provide a decision in as little as one business day.

How fast will I get the money?

Under normal circumstances, if you apply before 4pm on a business day and your application is approved, it is possible to have money in your account the next business day.

How much can I borrow?

The total amount of your loan will depend on the specific circumstances of your business. We consider a variety of factors to determine the health of your business and based on this information, Prospa may be able to provide you with funding. The Prospa Small Business Loan offers amounts up to $150K but you can apply for any of our products which offer funding up to $500K.

Do I need security to access the funds?

Prospa considers the health of a business to determine creditworthiness. For Small Business Loans or Business Lines of Credit, no asset security is required upfront to access up to $150K.

If you continue to meet your obligations under the facility, such as payment obligations (as detailed in your contract), security will never be required. For facilities over $150K, or where your combined exposure to our products exceeds $150K, Prospa takes security in the form of a charge over your assets.

A Prospa Small Business Loan can be used for almost any business purpose – including for growth, to take advantage of an opportunity or to support business cash flow. For example, it could be used for business renovations, marketing, to purchase inventory or new equipment, as general working capital and much more.

What are the fees?

There are no hidden fees for our Small Business loans, and you’ll know exactly how much and when you need to pay from day one. There’s no compounding interest and no additional fees (as long as you make your repayments on time).

Please note, not all amounts, term lengths or rates will be available to all applicants. Interest rates vary due to factors including the amount borrowed, the industry the business operates in, how long the business has been running, whether the business has sufficient cash flow to support the loan, and the overall ‘health’ or creditworthiness of the business.

Can I pay out my loan in full?

You can choose to repay the entire amount of your loan early at any time.

If you decide to do this please speak to our friendly business loan specialists on 1300 882 867. They will provide you with repayment details and an early payout figure. This will be calculated as the total of the remaining principal amount and any accrued interest at the date of early payout, plus 1.5% of the remaining principal and any outstanding fees.

How is the Prospa Small Business Loan different from a traditional business loan?

You can apply for the Prospa Small Business Loan in as little as 10 minutes online or over the phone. Depending on the time of day you apply, approvals can be achieved “same-day” with funds in your account within 24 hours. The Prospa Small Business Loan details the total amount payable upfront including any interest, fees or charges. This is then broken down into either a daily or weekly repayment figure.

Tell me about the Prospa Small Business Loan?

Prospa offers Small Business Loans of $5K to $150K with terms between 3 – 36 months and cash flow friendly repayments that are either daily or weekly.

What is a Simple Interest Rate per annum?

This is your total interest percentage expressed as an annualised rate. This is the amount of interest expressed as a percentage of the loan amount and does not include the cost of any fees.

What is an Annual Percentage Rate?

The Annual Percentage Rate is the rate that can be used to calculate the cost of the loan taking into account the reducing balance of the Loan Amount, expressed as an annual rate. This does not include the cost of any fees.

Can I speak to someone about a Small Business Loan?

Sure thing. Call our friendly team on 1300 882 867.

Our operating hours are Monday – Friday: 8:30am – 7pm (AEST)

The 6-week no repayment period offer is available to eligible new and existing customers who apply for a Prospa Small Business Loan or Prospa Business Loan Plus (each a “Loan”) that is approved and settled between 6 May 2024 and 30 June 2024 (inclusive) Customers approved for the offer may choose to make no loan repayments for a period of between 1 and 6 weeks from the Loan settlement date (“No Repayment Period”). During the No Repayment Period, interest will accrue as set out in the Loan contract (“Deferral Interest”). Following the end of the No Repayment Period, Deferral Interest will be paid in equal installments that form part of the regular repayments due on each payment date over the life of the Loan. The offer is only available to eligible businesses established and operating in Australia. The offer is not available in conjunction with any other Prospa offer and it may be withdrawn without notice. Existing customers must have a clear repayment history on previous Prospa products to be eligible and have no current Prospa Loan (unless that Prospa Loan is eligible for refinance). This offer will only be available when refinancing a current loan if at least 20% of the new loan amount consists of fresh capital. For example, refinancing a $100,00 loan requires fresh capital so the new loan total is at least $125,000. Loan and offer eligibility and approval subject to standard credit assessment criteria. Fees, terms and conditions apply.