Business Loans to match the needs of TAS small businesses

Why Prospa? Because we believe in small business.

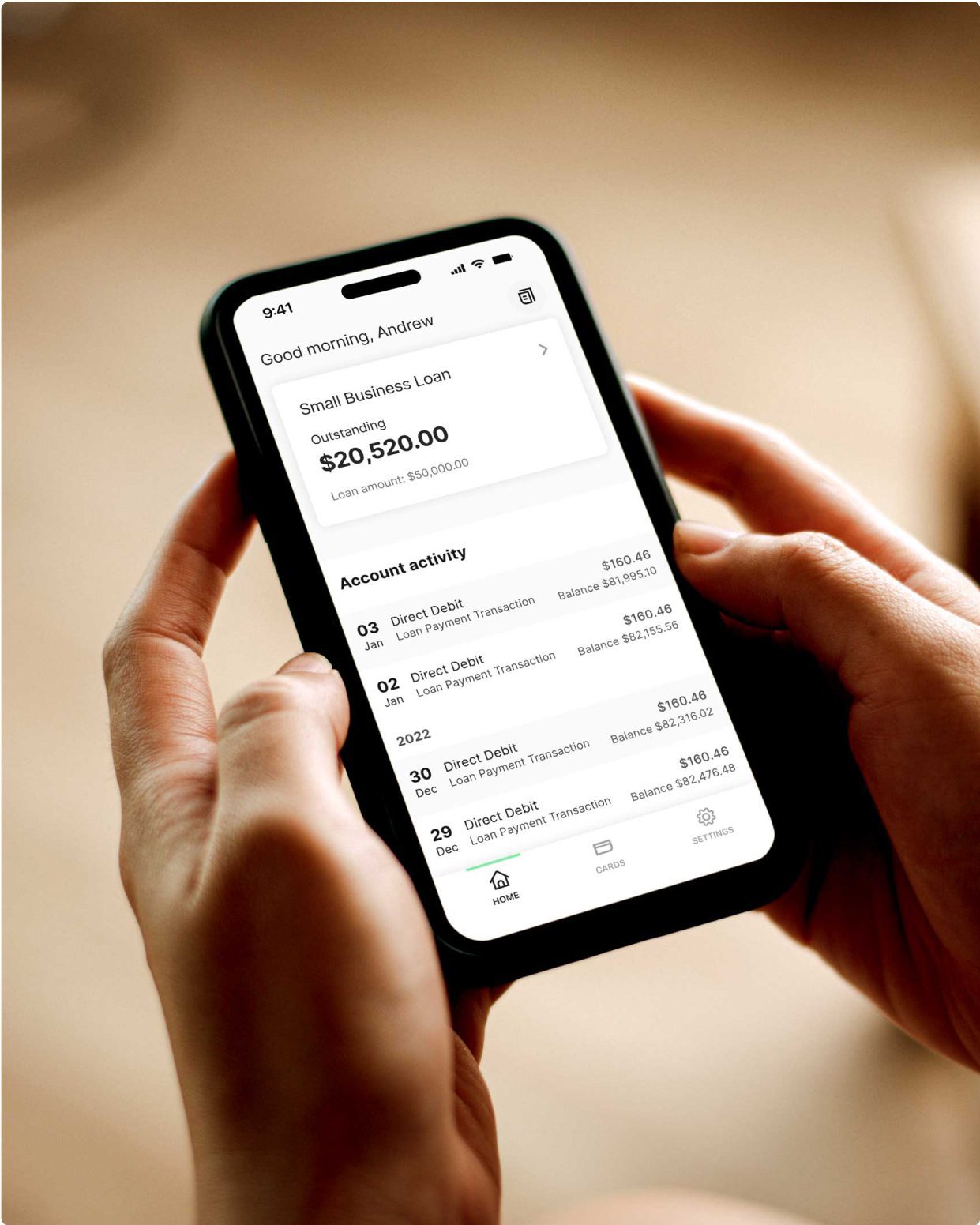

No more compromising or missed opportunities with Prospa by your side. With hassle-free application, this time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do.

We’re Australia’s #1 online lender to small business.

Flexibility

Support

Confidence

Flexible funding solutions for TAS small businesses

Whether it’s the vast, stunning landscapes, the well-preserved convict history, the charming villages or the amazing food, beverage and luxury accommodation experiences, Tasmania offers something for everyone. And all this is underpinned by almost 37,000 small businesses which employ 100,000 Tasmanians.

At Prospa, we are proud to support Tassie small business owners with hassle-free

access to funding. Feel confident to move fast on your next opportunity with a

fast decision on amounts up to $1M and funding possible in 24 hours.