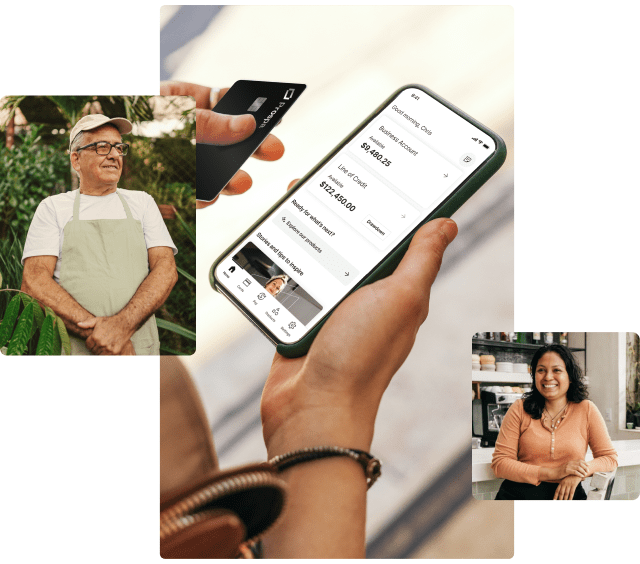

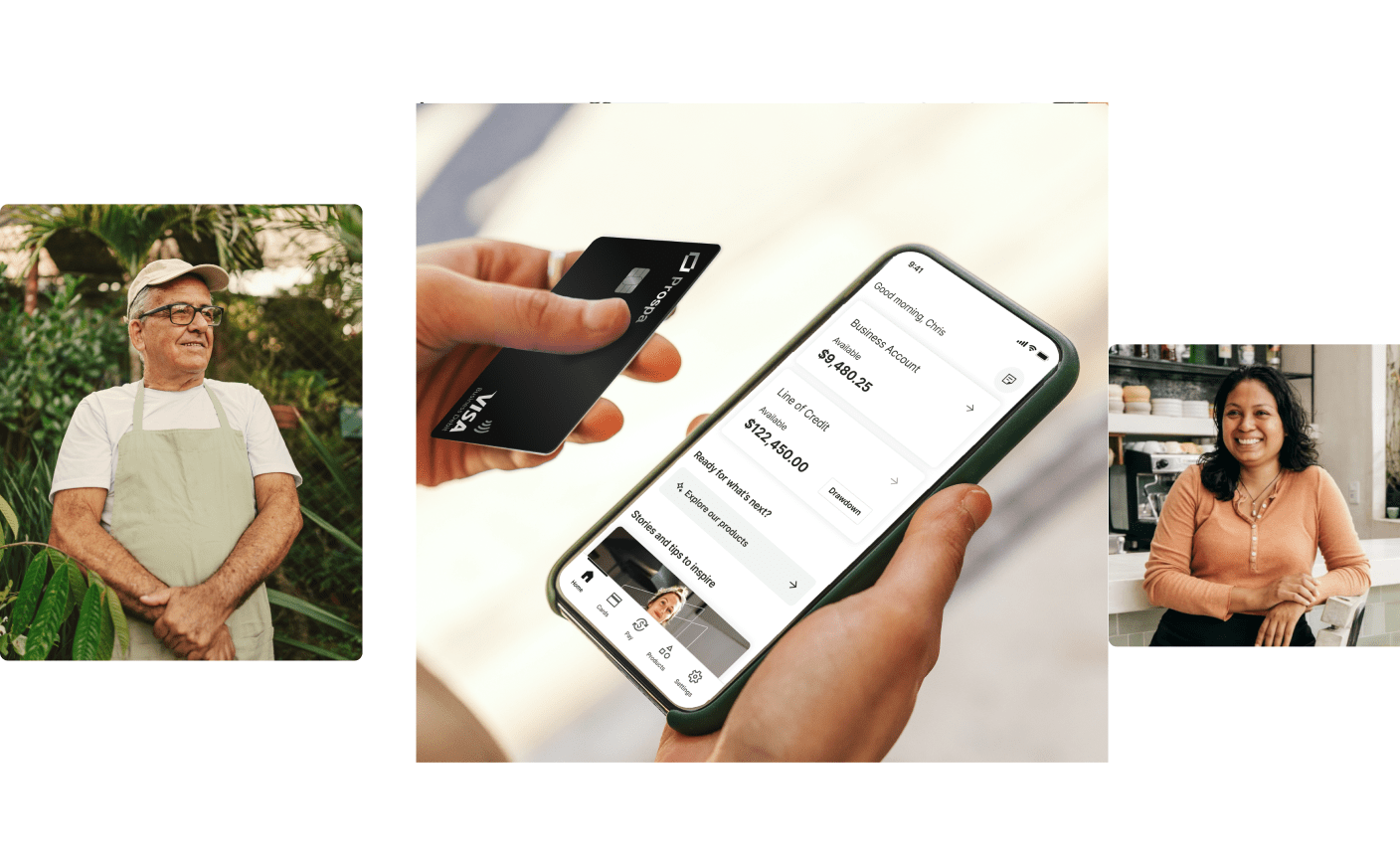

Let’s make business happen

Why Prospa

About us#1

online lender to small

business in Australia

12+

over 12 years of experience

$4B

Small business loans

50K

over 50K businesses funded

Talk to a business lending specialist

Leave your details below and one of our Business Lending Specialists will get in touch to help you find a solution that matches your needs.

How our customers have put their funds to work

Read customer storiesFAQs

Frequently asked questions

For a Business Loan or Line of Credit up to $150K, you must have:

- From 6 months trading history

- Monthly turnover of $6K

- Business owners must be 18+ years

- Business owners must be an Australian citizen or permanent resident

For a Business Loan or Line of Credit over $150K, you must have:

- Minimum 2 years trading history

- Annual turnover of $1M

- Property or asset ownership

- Business owners must be 18+ years

- Business owners must be an Australian citizen or permanent resident

The application process is easy and fast. Simply complete the online form in as little as 10 minutes. If you are applying for $150K or less, you need:

- Your driver licence number

- Your ABN

- Your BSB and account number

- Minimum trading history applies

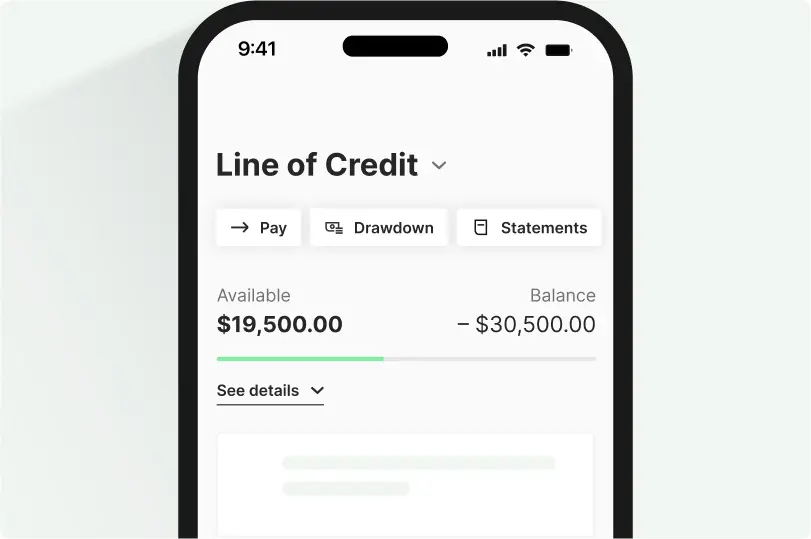

We offer Business Loans or Line of Credit up to $500K, however the total amount of your loan will depend on the specific circumstances of your business.

We consider a variety of factors to determine the health of your business and based on this information we will make an assessment on how much you can borrow.

Use our loan calculator to discover much you could afford to borrow.

We can often provide a response in as little as one hour – as long as you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements it may take a little longer.

Prospa considers the health of a business to determine creditworthiness. For Small Business Loans or Business Lines of Credit up to $150K, no asset security is required upfront to access. And provided you continue to meet your loan obligations (as detailed in your contract), asset security won’t be required.

For funding over $150K, or where your combined exposure to our products exceeds $150K, property ownership required, and asset security may be required.