On-the-spot clarity

Sync in moments

Simplify admin and save time

Safe and secure connection

FAQs

Common questions answered

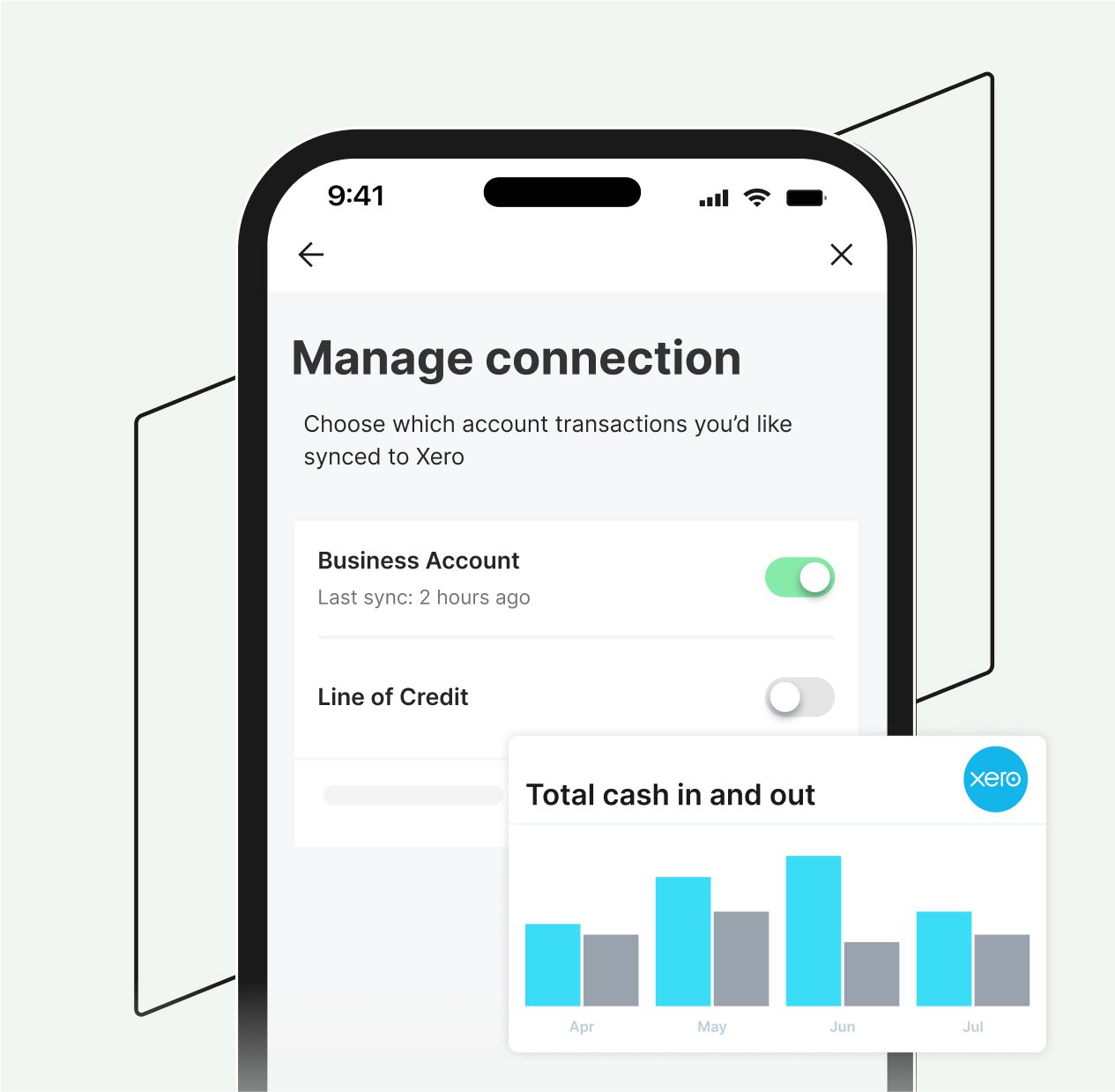

To sync transactions from your Business Account or Business Line of Credit to Xero, you’ll first need to connect your Prospa account to Xero through Prospa Online or on the Prospa App:

1. Log into Prospa Online or the Prospa App

2. Head to the Settings page

3. Click ‘Connect to Xero’

4. Agree to the terms and sign into Xero

5. Toggle sync on for the Prospa products you want to sync to Xero

You can tell whether you’re successfully connected and syncing to Xero by checking the connection status in the Settings page of Prospa Online or the Prospa App.

Once you’re syncing your Prospa Business Account or Prospa Business Line of Credit, transaction data will be automatically sent through to your Xero account every business day.

To remove the sync to Xero:

1. Log into Prospa Online or the Prospa App

2. Head to the Settings page

3. Click ‘Manage connection’

4. Toggle sync off for the Prospa products you want to stop syncing

5. Click ‘confirm’ to switch off sync

You can tell whether you’ve successfully removed the sync to Xero by checking the connection status in the settings page of Prospa Online or the Prospa App. Here it will say how many products you’re currently syncing to Xero. Note that it can take up to 24 hours for the connection status to update.

When you switch syncing off, we will no longer send transactions from the selected product to Xero. This won’t turn off all data sharing between Prospa and Xero. To revoke all data permissions, you can disconnect Xero.

You can switch on sync again for future transactions at any time.

To disconnect your Prospa account from Xero:

1. Log into your Prospa Online account or into the Prospa App

2. Head to the Settings page

3. Select ‘Manage connection’

4. Click ‘Disconnect Xero’

You can tell whether you’ve successfully disconnected Xero by checking the connection status in the settings page of Prospa Online or the Prospa App. Note that it can take up to 24 hours for the connection status to update.

When you disconnect from Xero, all access between Prospa and Xero will be revoked, and we’ll no longer send or receive data from Xero. You can reconnect at any time.

Transaction data is sent every business day. Please allow up to 24 hours for new transactions from your Business Account or Business Line of Credit to appear in Xero.

You can have peace of mind knowing your data is protected with bank-level security and encrypted connection.

Yes you can use either Prospa Online or the Prospa App to connect to Xero. You only need to connect from one and data will sync.

You can try to connect to Xero again or visit the Help Centre to troubleshoot.

If you use another accounting platform you can still export transactions by downloading your statements in CSV format and upload into other accounting software or provide to your accountant.

This feature is not yet available for Prospa Small Business Loans. If you sign up for a Business Account and you make your loan repayments from this account, you can sync these transactions to Xero by connecting and switching on sync for your Business Account.

Information about the Prospa Business Account is provided by Hay Limited (ABN 34 629 037 403 & AFSL 515459), the issuer of the Prospa Business Account and Prospa Visa Business Debit Card. Prospa Innovations Pty Ltd (ABN 98 609 580 734), a wholly owned subsidiary of Prospa Advance Pty Ltd (ABN 47 154 775 667), is a corporate authorised representative (AFS representative number 1313363) of Hay Limited.