Funding takes

your

business

further

Fast access to flexible funding solutions

and a dedicated

business account to

support cash flow and business growth.

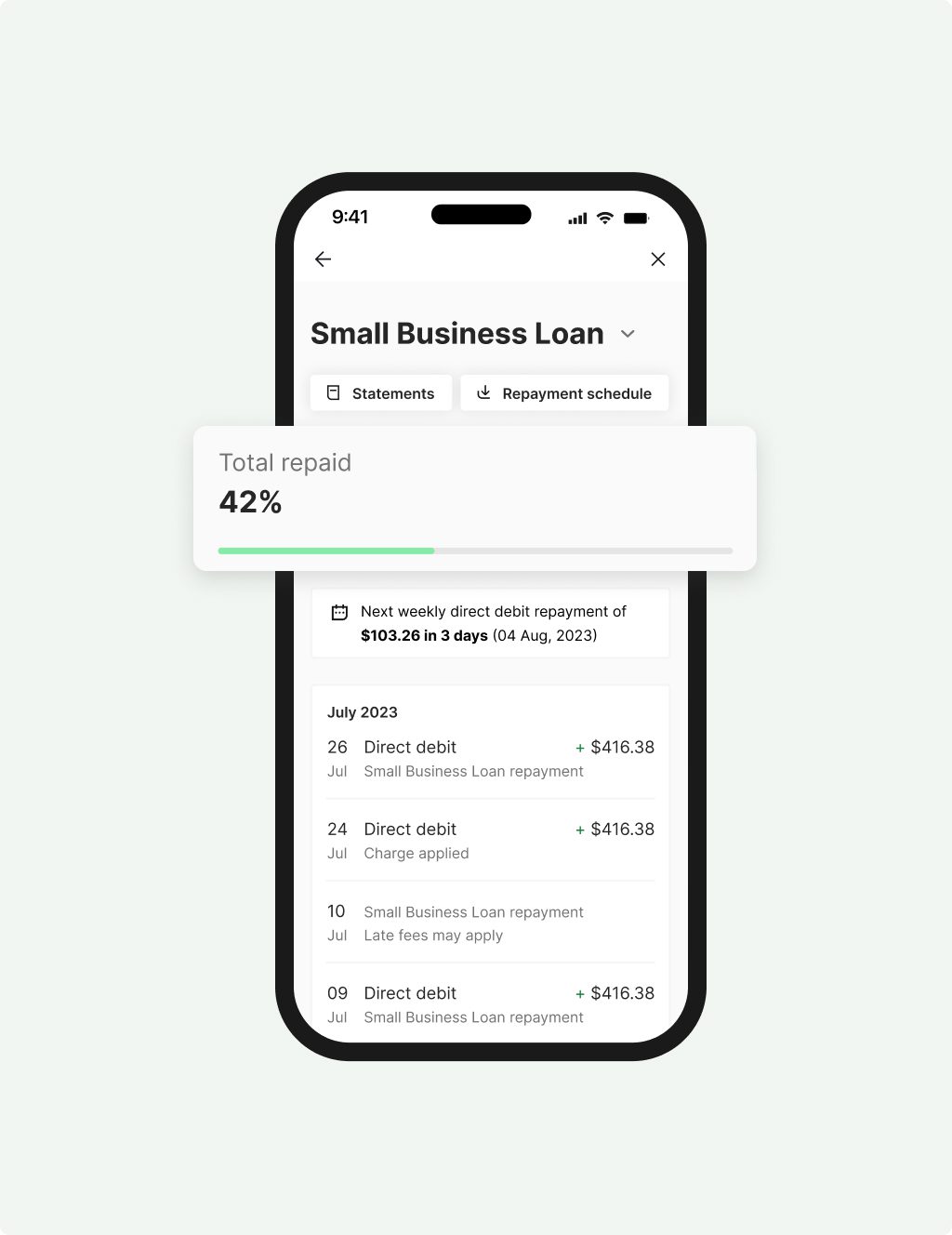

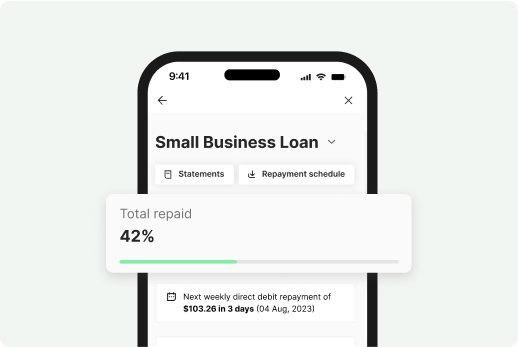

Prospa Small

Business Loan

Borrow from $5,000 to $150,000 as a lump sum over a fixed term of up to 36 months. Great for managing cash flow, buying stock and equipment, or covering unexpected expenses.

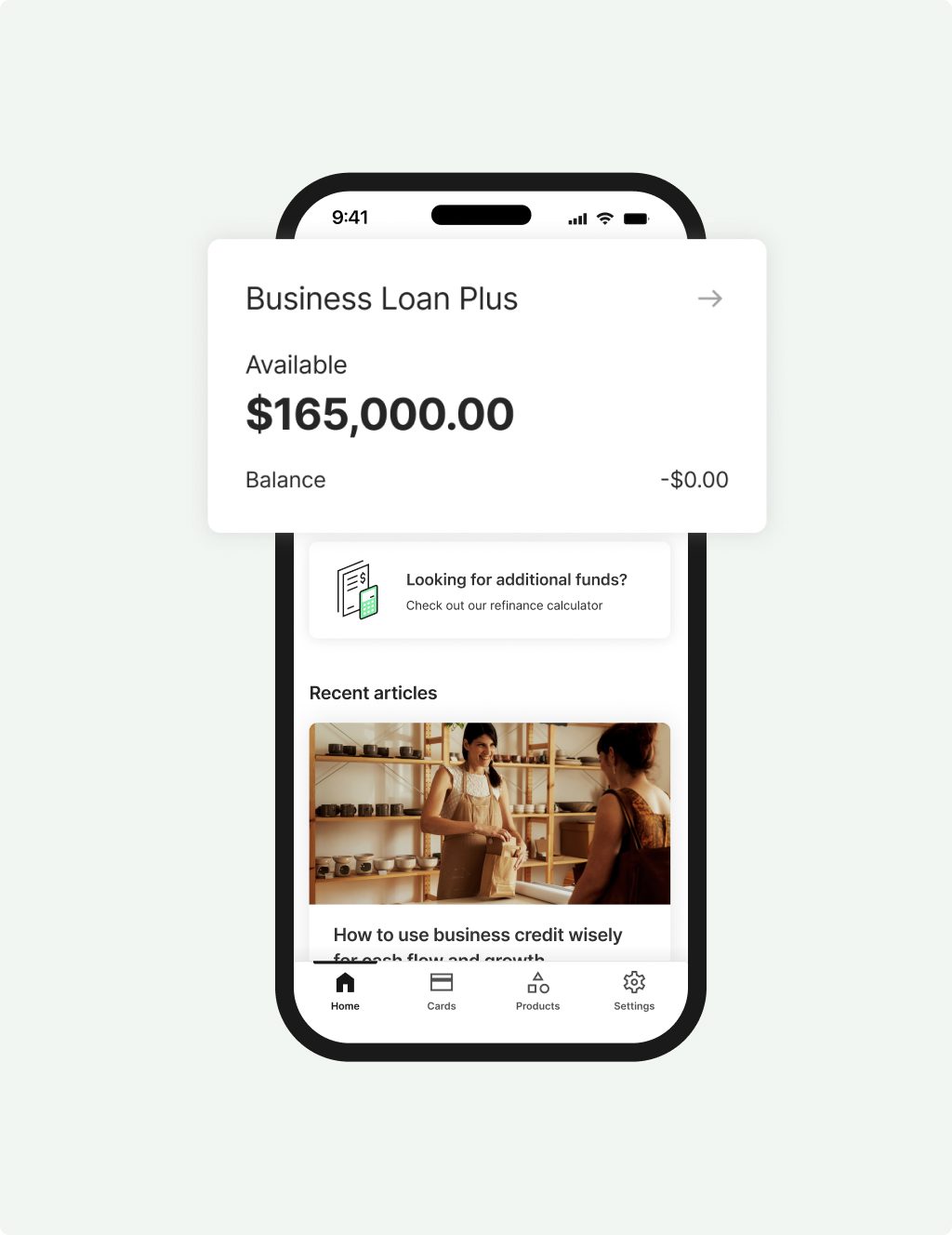

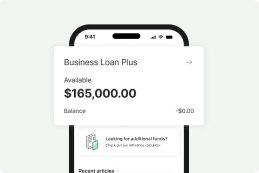

Prospa Business

Loan Plus

Borrow from $150,000 to $500,000 as a lump sum over a fixed term of up to 36 months. Often used for funding growth, renovations and refits, or equipment purchases.

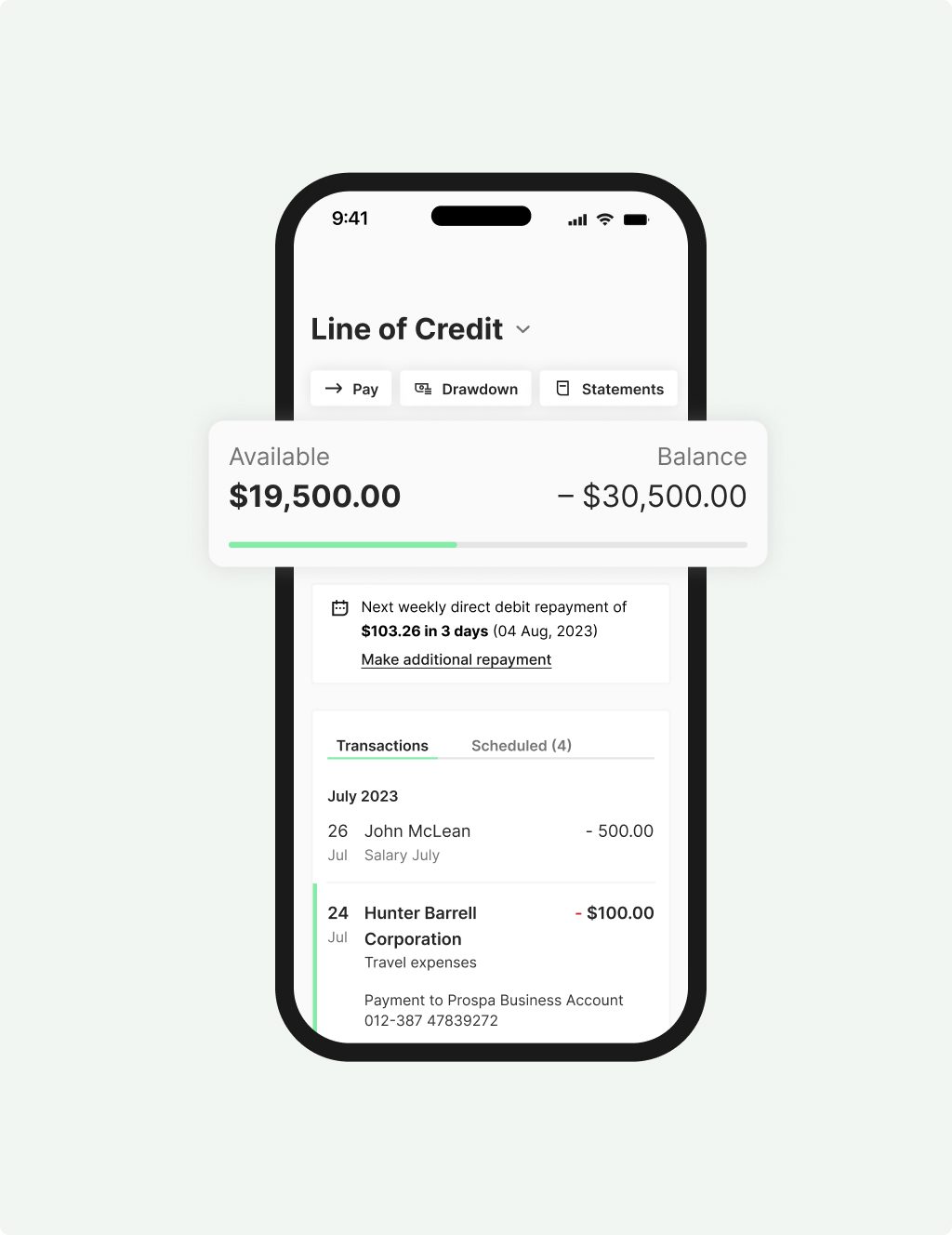

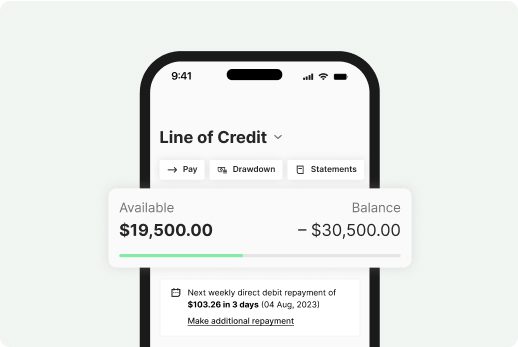

Prospa Business

Line of Credit

Get ongoing access to funds up to $150,000 and only pay interest on the funds you use. Ideal for managing cashflow and unexpected expenses.

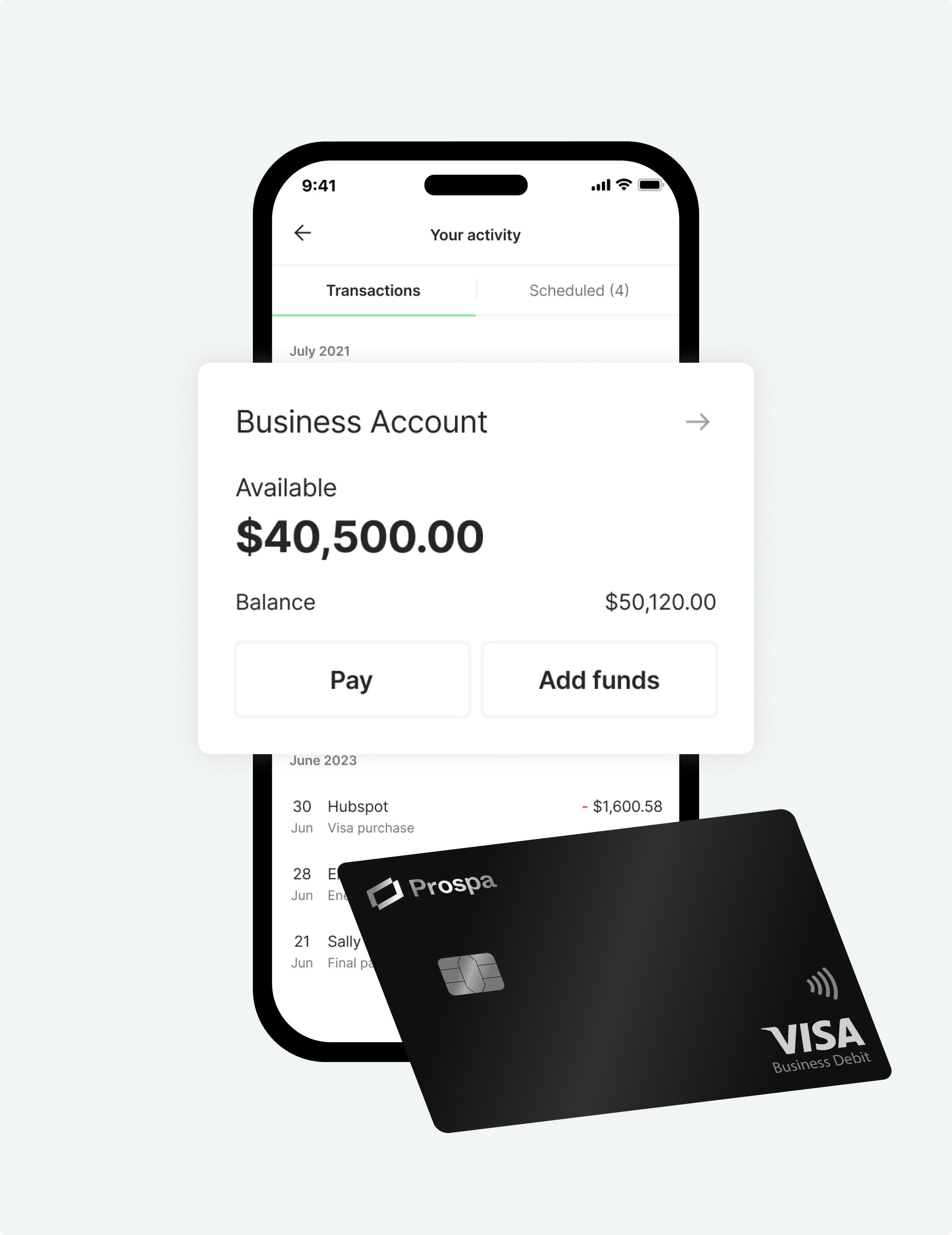

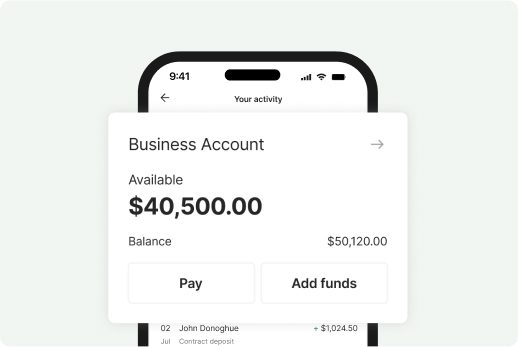

Prospa Business Account

Our new, free everyday transaction account is purpose-built to help businesses manage their everyday finances and cash flow, all in one place.

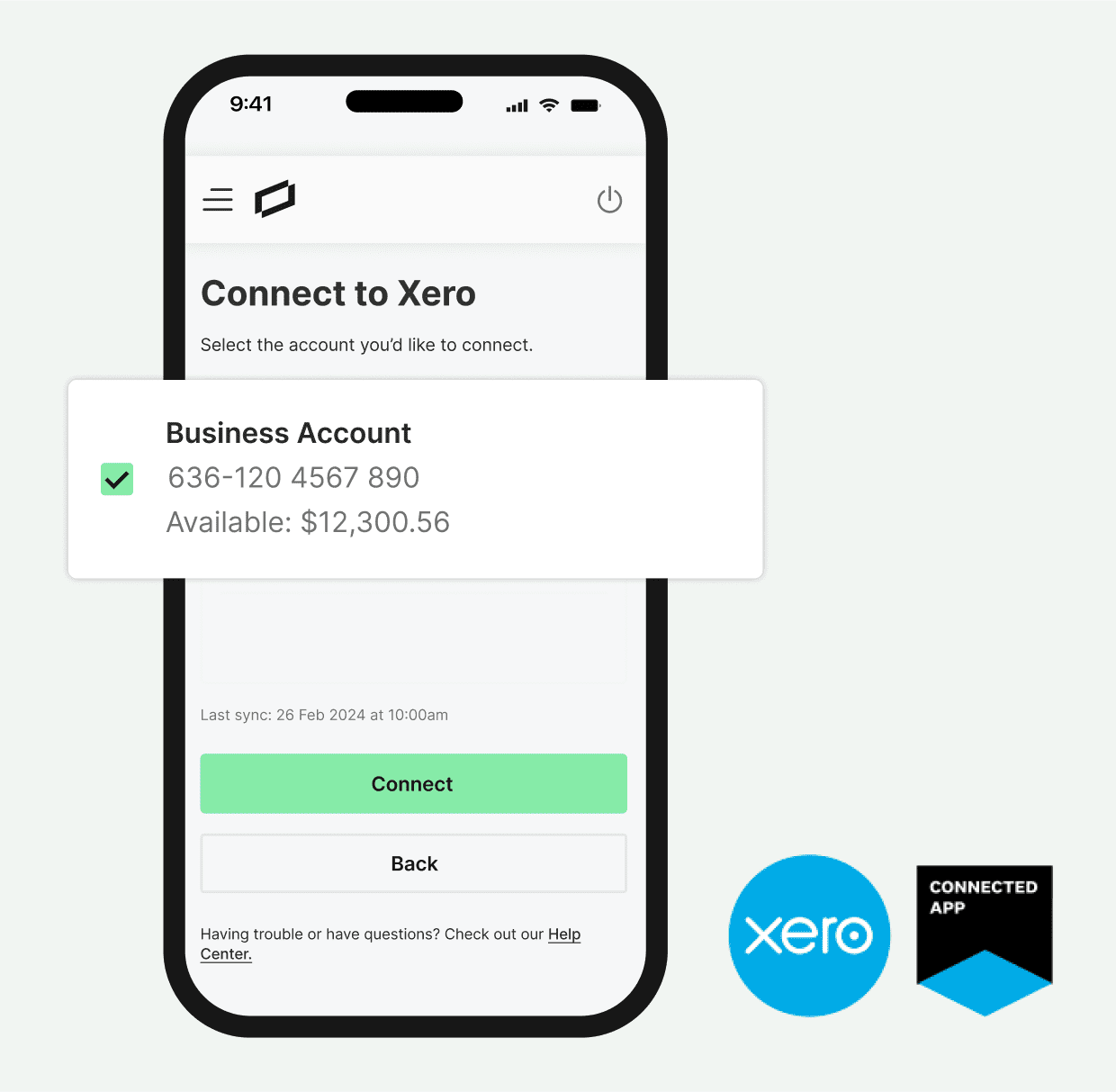

Integrate a Prospa Business Account to Xero

01

Apply online in under 10 minutes

02

Get a same-day decision

03

Access your funds

01

Apply online in under 10 minutes

02

Get a same-day decision

03

Access your funds

Business lending specialists

How our customers have put their funds to work

Read customer storiesWe're number one, thanks to you

Learn more#1

online lender to small

business in Australia

10+

years in business

65+

awards and counting

4.9/5

average Trustpilot review score

Recent articles

Stories to inspire you,

tips to save you time

FAQs

Common questions answered

We can often provide a response in one hour – as long as you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements we can provide a decision in as little as one business day.

If you apply before 4pm on a business day and your application is approved, it is possible to have money in your account the next business day.

The total amount of your loan will depend on the specific circumstances of your business. We consider a variety of factors to determine the health of your business and based on this information, Prospa may be able to provide you a loan amount up to $150K.

When you apply for our business loan, we will assess the risk profile of your business and provide you with a customised offer including loan amount, term and interest rate. Interest rates vary based on things like your industry, how long you’ve been in business, and the health of your cash flow.

When you take out a business loan with Prospa, the only fee you will incur is an origination fee. There are no hidden fees for our business loans, and you’ll know exactly how much you need to pay and when from day one. There’s no compounding interest and no additional fees (as long as you make your payments on time).

If you wish to receive your individual rate from Prospa, you should call on 1300 882 867 or complete our .

To help you avoid missing repayments we’ll automatically deducted your repayments from your nominated business account weekly. You can also choose to repay the entire amount of your loan early at any time. If you decide to do this please speak to our friendly business loan specialists on 1300 671 307. They will provide you with repayment details and an early payout figure. This will be calculated as the total of the remaining principal amount and any accrued interest at the date of early payout, plus 1.5% of the remaining principal and any outstanding fees.

Protecting your information, and being clear about how we collect, use, exchange and protect your information, is of huge importance and a vital part of our relationship with you. View our Privacy Policy.

Yes. We use industry recognised encryption standards to protect your personal, sensitive and financial data and are ISO27001 certified, validating our commitment to customer data security and privacy. We use an advanced bank verification system link to instantly verify your bank account information online so we can provide a fast response.

Prospa considers the health of a business to determine credit worthiness. For Small Business Loans or Business Lines of Credit, no asset security is required upfront to access up to $150K.

If you continue to meet your obligations under the facility, such as payment obligations (as detailed in your contract), security will never be required. For facilities over $150K, Prospa takes security in the form of a charge over your assets.

See more on how to get a small business loan – the easy way.

If you need flexible finance for business, we are Australia’s #1 online lender to small business and we can help. Our dedicated customer support team will understand your business and find a finance solution to suit your needs. We work with Australian small business owners from NSW to QLD, Victoria to WA and everywhere in between to take the hassle out of business loans.

Unlike traditional lenders, we don’t require the usual pages of reports, financial statements and business plans when you apply. Instead, we offer a quick online application with a fast decision and funding possible in 24 hours. Minimum trading history applies, your ABN and a drivers licence to get started.

If you’re concerned about being baffled by banking jargon, we’ve simplified our loan application process so there’s no more complex terminology around cash flow, low interest loans, fixed rate loans versus variable rates, the loan term, terms and conditions and whether you are in a position to refinance in the future. It’s simple and easy to understand with Prospa.

With Prospa you’ll have a clear understanding of what’s expected, how much your set repayments will be, whether they’re daily or weekly, when they’ll be due, the total amount you’ll pay back by the end of your loan, and your payment options.

Call 1300 882 867 to get started on your business loan application today.

There are a number of options you can explore when you want to compare business financing options. Here are some to think about:

Equipment financing: Equipment loans are a way to finance purchases of equipment for your business. This type of finance is usually secured against the value of the business asset you wish to purchase. This can sometimes help to secure a low rate, although this isn’t always the case. So, if you need to purchase business machinery, IT equipment, tools, or even work vehicles, a Prospa business loan could be a good alternative to equipment finance.

Vehicle finance, Business car loan, Machinery finance: This can be a handy way of updating your fleet vehicles or to cover the cost of large assets like harvesters, excavators, commercial cookers, etc. A Prospa small business loan may be able to cover these items, talk to us today to find out more.

Business overdraft: Also known as a business line of credit, this handy type of finance can help small businesses cover short-term cash flow gaps. It is often used to cover bills like payroll which can fluctuate if you employ seasonal casuals. It’s also useful to pay suppliers on time if you’re waiting for your own invoices to be paid by your customers.

Some commercial loans require a deposit. And while you don’t need a deposit to apply for a business loan with Prospa, it is a good idea to have a clear understanding of all of your finances before you apply. It’s OK if you don’t have pages and pages of financial analysis to reference. We understand that small business operators are up against it and often struggle to keep up with the paperwork. To apply for up to $150,000, minimum trading history periods apply, an ABN and your drivers licence

Like traditional lenders, Prospa conducts credit checks to look at your personal credit score in conjunction with your business health. Credit reporting bodies will compile a report on your credit worthiness based on a range of factors which include how many loan applications you have already made, your current credit if you have any, any overdue bills, past bankruptcy if applicable and any pending writs or court judgments.

At Prospa, we don’t rely solely on your personal credit score, we focus on evaluating the health of your business. We have developed a complex credit assessment tool which takes into account over 450 separate pieces of information. It’s unique to Prospa and allows us to take the time to really understand how your business operates and what loan amount will be the most applicable to your business’s long-term stability.

If you apply for a loan of $5,000 to $150,000, minimum trading history periods apply. If you need $150,000 to $500,000 we’ll require additional financials like a P&L statement. If you are ready to find out how much you can borrow and ready to find a better way to finance your business, contact a member of our friendly customer service team today on 1300 882 867 or fill out a quick and hassle-free online form.

Yes. After building a strong presence in the Australian SME market, Prospa launched into New Zealand in March 2019. The challenges for business owners in New Zealand wanting to access finance were similar to those in Australia. In fact, small business loans in New Zealand were previously only available from larger financial institutions, that didn’t seem to offer the products and services that small business owners were looking for. With over half a million small businesses in New Zealand, the opportunities to support the growth and cash flow of this sector were attractive to Prospa. With applications in under 10 minutes and funding possible in as little as 24 hours, the launch of a small business focused lender like Prospa was welcomed with open arms by small businesses and brokers alike.

Other questions?